Transforming Financial Data into Insights with Securitization Loan Audits

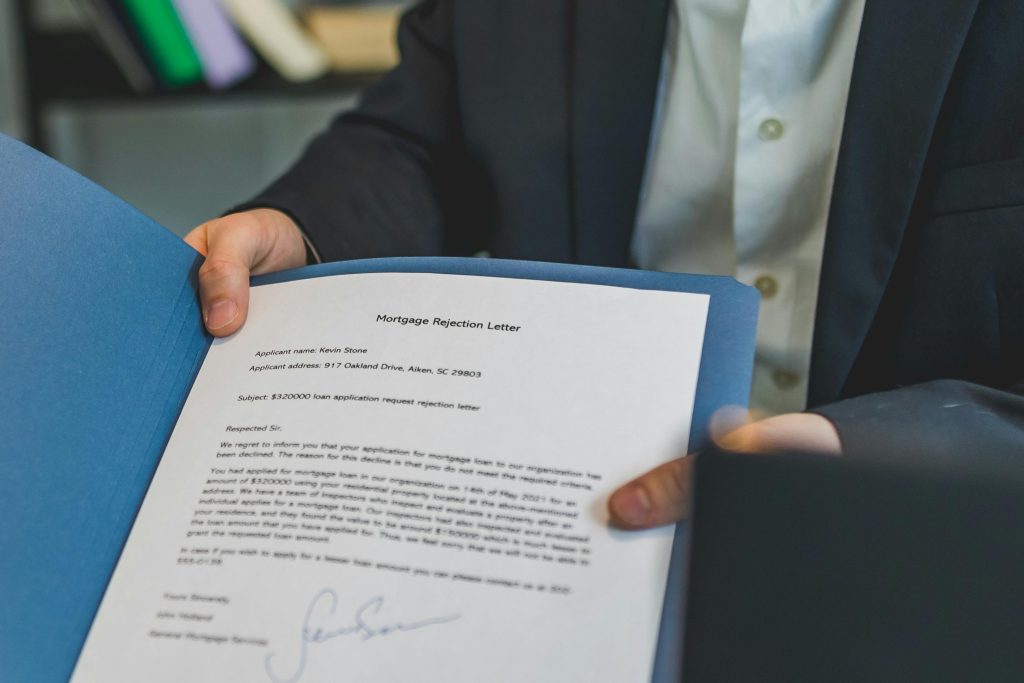

In today’s fast-evolving financial landscape, the importance of turning raw data into actionable insights cannot be overstated. This is particularly true when it comes to mortgage securitization audits. These audits act as a crucial bridge, enabling individuals and institutions to uncover irregularities, safeguard investments, and ensure compliance with financial regulations. Whether you’re a homeowner seeking […]

Transforming Financial Data into Insights with Securitization Loan Audits Read More »