Corporate Issuer Identification: Navigating Regulatory Compliance and Disclosure Requirements

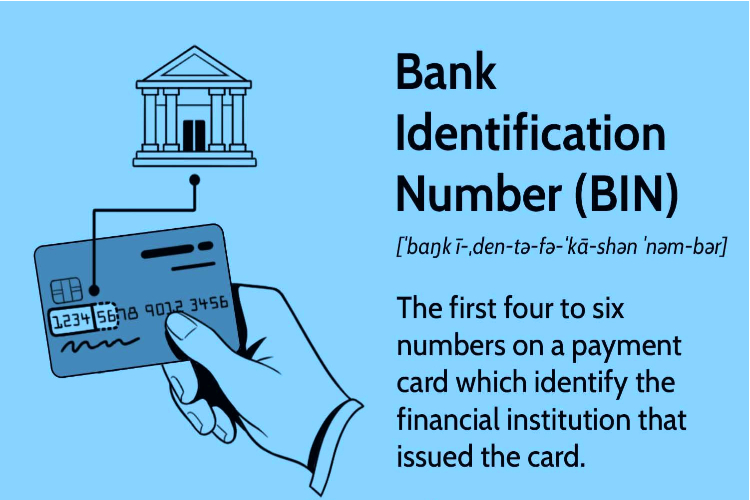

In the dynamic landscape of financial markets, the identification of corporate issuers stands as a cornerstone for investors, analysts, and regulatory bodies alike. As capital flows across borders and investment vehicles diversify, the importance of accurate issuer identification becomes increasingly pronounced. Against this backdrop, this article delves into the intricate realm of corporate issuer identification, […]