The Power of Securitization Loan Audits: Preserve your Financial Future

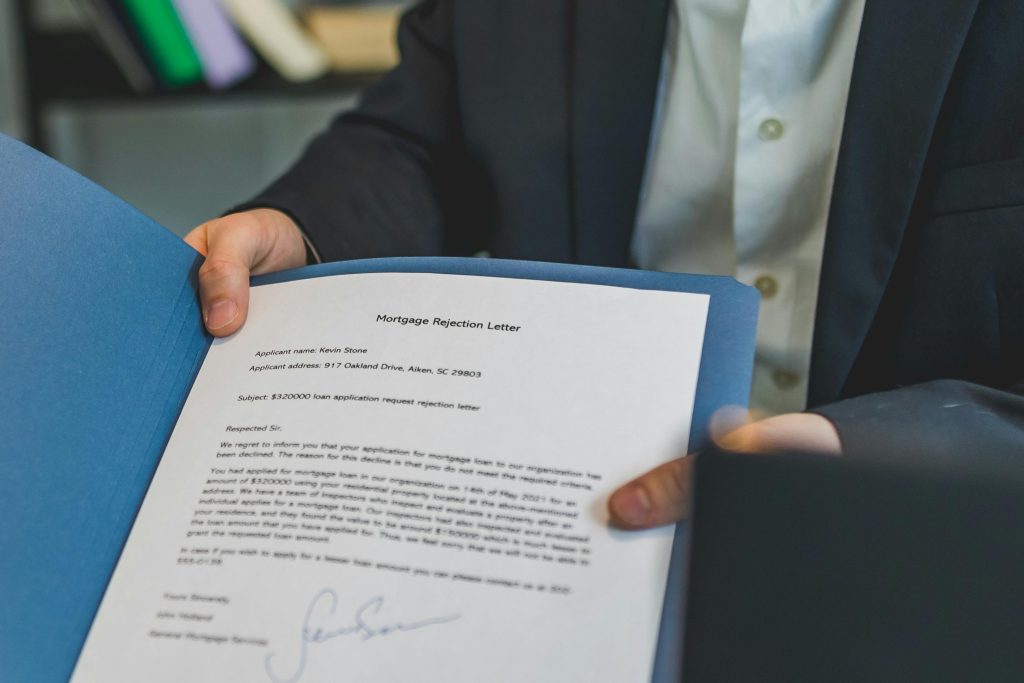

Introduction The financial landscape of mortgage lending is complex, with securitization becoming a dominant practice. This process, while innovative, has introduced a myriad of challenges, including documentation errors, legal non-compliance, and instances of outright fraud. Amid these complexities, securitization loan audits have emerged as a crucial solution to safeguard the interests of homeowners, investors, and other […]

The Power of Securitization Loan Audits: Preserve your Financial Future Read More »