In the mortgage markets, comprehensive understanding of key factors such as pool factor and prepayment reporting is paramount for professionals navigating the intricate realms of finance and real estate. As the global economy continues to evolve, the significance of these concepts becomes increasingly evident, influencing investment strategies, risk management practices, and overall market dynamics.

In the mortgage markets, comprehensive understanding of key factors such as pool factor and prepayment reporting is paramount for professionals navigating the intricate realms of finance and real estate. As the global economy continues to evolve, the significance of these concepts becomes increasingly evident, influencing investment strategies, risk management practices, and overall market dynamics.

Pool factor, a fundamental metric in mortgage-backed securities (MBS), represents the ratio of remaining principal balance to the original principal balance of a mortgage pool. It serves as a crucial determinant in assessing the performance and profitability of MBS investments, guiding investors in making informed decisions amidst fluctuating market conditions. Understanding the nuances of pool factor enables financial professionals to gauge the risk exposure and potential returns associated with mortgage-backed assets, thereby optimizing portfolio allocation and enhancing investment outcomes.

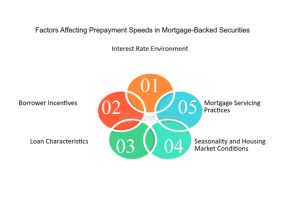

Additionally, prepayment reporting plays a pivotal role in mortgage markets by providing insights into the pace at which borrowers repay their loans ahead of schedule. This phenomenon, influenced by various economic factors and borrower behavior, directly impacts the cash flows and yields of MBS investments. By analyzing prepayment trends and forecasts, industry professionals can anticipate cash flow variability, mitigate risk, and devise effective hedging strategies to safeguard investment portfolios against adverse market movements.

In this ever-evolving financial landscape, mastery of pool factor and prepayment reporting equips professionals with the knowledge and analytical tools necessary to navigate complexities, capitalize on opportunities, and drive sustainable success in mortgage markets.

After grasping the fundamentals of pool factor and prepayment reporting, the next step for professionals involves delving deeper into their implications and applications within mortgage markets. This entails exploring various subtopics to enhance comprehension and proficiency in leveraging these concepts effectively. Here are four key subheadings:

Analyzing Pool Factor Dynamics:

- This section involves a detailed examination of the factors influencing pool factor fluctuations over time.

- Professionals need to understand how changes in interest rates, economic conditions, and borrower behavior impact the composition and performance of mortgage pools.

- By conducting thorough analyses of pool factor trends, practitioners can identify patterns, assess risk exposure, and make informed investment decisions.

Strategies for Managing Prepayment Risk:

- Prepayment risk poses a significant challenge for investors in mortgage-backed securities, as it can disrupt expected cash flows and alter investment returns.

- Professionals need to explore various strategies for managing prepayment risk, such as diversification, duration matching, and the use of derivative instruments.

- Understanding the trade-offs between risk and return is essential in developing effective risk mitigation strategies tailored to specific investment objectives and market conditions.

Utilizing Prepayment Models and Analytics:

- Prepayment models and analytics play a crucial role in forecasting future prepayment behavior and assessing its impact on MBS performance.

- Professionals should familiarize themselves with commonly used prepayment models, such as the Single Monthly Mortality (SMM) model and the Conditional Prepayment Rate (CPR) model.

- By leveraging advanced analytics and scenario analysis, practitioners can gain deeper insights into prepayment dynamics, refine investment strategies, and optimize portfolio performance.

Integration with Portfolio Management Practices:

- Integrating pool factor and prepayment analysis into portfolio management practices is essential for maximizing risk-adjusted returns and achieving investment objectives.

- Professionals should explore methodologies for incorporating these metrics into asset allocation decisions, portfolio rebalancing strategies, and performance monitoring processes.

- By aligning pool factor and prepayment considerations with broader portfolio management objectives, practitioners can enhance portfolio resilience, minimize downside risk, and capitalize on market opportunities.

By exploring these subtopics in depth, professionals can further enhance their expertise in pool factor and prepayment reporting, enabling them to navigate mortgage markets with confidence and precision.

Continuing Advancement in Mortgage Market Expertise

- Refine Modeling Techniques: Continue refining modeling techniques for pool factor dynamics and prepayment risk, incorporating advanced statistical methods and machine learning algorithms to improve forecasting accuracy.

- Stay Abreast of Market Trends: Stay abreast of market trends and regulatory developments impacting mortgage markets, attending industry conferences, workshops, and webinars to remain informed and adapt strategies accordingly.

- Expand Knowledge Base: Expand your knowledge base by exploring related areas such as mortgage servicing rights (MSRs), mortgage origination processes, and securitization structures to gain a holistic understanding of the mortgage ecosystem.

- Collaborate with Peers: Collaborate with peers and industry experts through networking events, discussion forums, and professional associations to exchange insights, best practices, and innovative approaches to mortgage market analysis and investment management.

- Continual Learning and Development: Engage in continual learning and professional development opportunities, pursuing certifications such as Chartered Financial Analyst (CFA), Certified Mortgage Banker (CMB), or Financial Risk Manager (FRM) to enhance credibility and expertise in mortgage finance.

Honing specialized skills and deepening of understanding through practical application

Here’s how to proceed:

- Practical Application of Concepts:

- Apply theoretical knowledge of pool factor dynamics and prepayment risk management to real-world scenarios. Engage in case studies, simulations, and practical exercises to reinforce understanding and develop hands-on expertise.

- Data Analysis and Interpretation:

- Dive deeper into data analysis techniques, leveraging statistical software and programming languages like R or Python to analyze mortgage data sets. Practice interpreting results, identifying trends, and extracting actionable insights to inform decision-making processes.

- Risk Management Strategies:

- Develop and implement comprehensive risk management strategies tailored to specific investment objectives and risk tolerance levels. Explore hedging techniques, scenario analysis, and stress testing methodologies to mitigate potential downside risks associated with pool factor dynamics and prepayment volatility.

- Continuous Monitoring and Adaptation:

- Establish robust monitoring mechanisms to track portfolio performance metrics, prepayment trends, and market developments in real-time. Stay agile and adaptable, adjusting investment strategies and risk management approaches as market conditions evolve and new challenges emerge.

- Collaboration and Knowledge Sharing:

- Foster collaboration and knowledge sharing within interdisciplinary teams, leveraging diverse perspectives and expertise to address complex mortgage market dynamics effectively. Participate in cross-functional projects, workshops, and brainstorming sessions to generate innovative solutions and drive continuous improvement initiatives.

By embracing these steps, professionals can embark on a journey of continual learning and skill enhancement, positioning themselves as adept practitioners in the dynamic landscape of mortgage finance.

Conclusion

In conclusion, mastering pool factor dynamics and prepayment reporting is pivotal for navigating the complexities of mortgage markets. By honing analytical skills, implementing risk management strategies, and fostering collaboration, professionals can enhance decision-making, optimize investment outcomes, and adapt to evolving market conditions. Through continual learning and practical application, practitioners can fortify their expertise and contribute to the resilience and sustainability of mortgage finance in an ever-changing economic landscape.

Disclaimer: “This article is for educational & entertainment purposes.”