The International Securities Identification Number (ISIN) system serves as a crucial cornerstone of global financial markets, providing a standardized method for uniquely identifying securities such as stocks, bonds, and other financial instruments. Developed by the International Organization for Standardization (ISO), the ISIN system offers a unique code for each security, enabling efficient and accurate tracking, trading, and settlement across international borders.

The International Securities Identification Number (ISIN) system serves as a crucial cornerstone of global financial markets, providing a standardized method for uniquely identifying securities such as stocks, bonds, and other financial instruments. Developed by the International Organization for Standardization (ISO), the ISIN system offers a unique code for each security, enabling efficient and accurate tracking, trading, and settlement across international borders.

In this comprehensive overview, we delve into the fundamental principles and operational intricacies of the ISIN system. Beginning with the historical context and evolution of ISIN, we explore its significance in fostering transparency, liquidity, and investor confidence in today’s interconnected financial landscape.

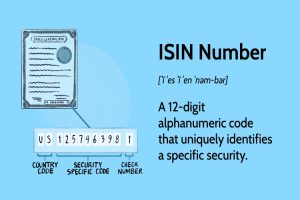

Furthermore, we analyze the structure of the ISIN code itself, deciphering its components and their respective meanings. From country codes to security identifiers, understanding the anatomy of an ISIN facilitates seamless communication and data exchange among market participants worldwide.

Moreover, we highlight the role of regulatory bodies and market infrastructures in enforcing ISIN standards and ensuring compliance with reporting requirements. Additionally, we examine the practical applications of ISIN in various financial activities, including trading, settlement, and risk management.

By offering a comprehensive overview of the ISIN system, this exploration aims to equip investors, financial professionals, and regulatory authorities with the knowledge necessary to navigate the complexities of global securities markets effectively.

Operational technicalities of ISIN

Continuing our exploration, we delve deeper into the operational technicalities of the ISIN system and its practical implications across diverse sectors of the financial industry.

One of the primary functions of the ISIN system is to facilitate efficient trading and settlement processes. By assigning a unique identifier to each security, the ISIN streamlines the identification of assets, thereby reducing the risk of errors and enhancing transactional efficiency. Market participants, including brokers, traders, and clearinghouses, rely on ISINs to accurately identify securities during trade execution and settlement. This standardized approach fosters interoperability among different trading platforms and enhances market liquidity by facilitating seamless exchange of securities.

Furthermore, the ISIN system plays a pivotal role in risk management and regulatory compliance. Financial regulators and supervisory authorities utilize ISINs to monitor market activities, assess systemic risks, and enforce regulatory requirements. For instance, regulatory reporting mandates often require market participants to include ISINs in their submissions, enabling regulators to track the trading and ownership of specific securities across markets and jurisdictions.

Moreover, the ISIN system supports transparency and investor protection initiatives by providing comprehensive information about securities. Investors can use ISINs to access essential details such as issuer information, asset class, maturity dates, and coupon rates. This transparency fosters informed decision-making and helps investors evaluate the risks and rewards associated with different securities.

Additionally, the ISIN system facilitates the integration of securities data into various financial applications and systems. Market data providers, financial software vendors, and investment platforms utilize ISINs to organize, analyze, and disseminate information to their clients. This standardized approach enhances data accuracy, interoperability, and accessibility, thereby empowering market participants with timely and reliable information.

The International Securities Identification Number (ISIN) system serves as a linchpin of global financial markets, providing a standardized and universally recognized method for identifying securities. From facilitating trading and settlement processes to enhancing risk management and investor protection, the ISIN system plays a multifaceted role in ensuring the integrity and efficiency of modern financial infrastructure.

Enhancing risk management and investor protection

It is a critical function of the International Securities Identification Number (ISIN) system, contributing to the stability and integrity of financial markets worldwide.

Firstly, ISINs play a pivotal role in risk management by enabling market participants to accurately assess and manage their exposure to various types of securities. By uniquely identifying each security, ISINs facilitate the aggregation of positions across portfolios, asset classes, and geographical regions. Risk managers rely on ISINs to monitor concentration risks, assess portfolio diversification, and conduct stress testing scenarios. This granular level of identification enhances risk measurement accuracy and enables proactive risk mitigation strategies.

Secondly, the ISIN system supports regulatory compliance initiatives aimed at safeguarding investor interests and market integrity. Regulatory authorities mandate the use of ISINs in financial reporting and disclosure requirements, ensuring transparency and accountability in the issuance and trading of securities. By standardizing the identification of securities, ISINs enable regulators to track market activities, detect potential market abuses, and enforce regulatory frameworks effectively. This regulatory oversight helps prevent market manipulation, insider trading, and other fraudulent activities, thereby fostering investor confidence and market stability.

Moreover, ISINs facilitate investor protection by providing essential information about securities to market participants. Investors can use ISINs to access detailed descriptions of securities, including issuer information, asset class, terms and conditions, and relevant risk factors. This transparency empowers investors to make informed investment decisions, evaluate the risk-return profile of securities, and assess their suitability within their investment objectives and risk tolerance.

Overall, the ISIN system serves as a critical tool for enhancing risk management practices and safeguarding investor interests in global financial markets. By promoting transparency, standardization, and regulatory compliance, ISINs contribute to the resilience and efficiency of the financial ecosystem, fostering trust and confidence among market participants.

Conclusion

In conclusion, the International Securities Identification Number (ISIN) system stands as a cornerstone of modern financial infrastructure, playing a pivotal role in enhancing risk management practices and safeguarding investor interests worldwide. By providing a standardized method for identifying securities, ISINs enable market participants to accurately assess and manage their exposure to various types of assets, contributing to the stability and integrity of financial markets. Moreover, ISINs support regulatory compliance efforts, ensuring transparency and accountability in the issuance and trading of securities, thereby bolstering investor confidence and market stability.

Additionally, ISINs facilitate investor protection by providing essential information about securities, empowering investors to make informed decisions aligned with their objectives and risk tolerance levels. Through its promotion of transparency, standardization, and regulatory compliance, the ISIN system fosters trust and confidence among market participants, ultimately contributing to the resilience and efficiency of the global financial ecosystem.

Disclaimer: “This article is for educational & entertainment purposes.”