In the complex world of financial markets, mortgage debt-backed derivatives have emerged as both a cornerstone of investment strategies and a source of profound economic impact. As the global economy continually evolves, understanding the landscape of these derivatives becomes increasingly crucial for investors, policymakers, and financial institutions alike. This article endeavors to assess the multifaceted landscape of mortgage debt-backed derivatives, shedding light on the opportunities they present and the challenges they entail.

In the complex world of financial markets, mortgage debt-backed derivatives have emerged as both a cornerstone of investment strategies and a source of profound economic impact. As the global economy continually evolves, understanding the landscape of these derivatives becomes increasingly crucial for investors, policymakers, and financial institutions alike. This article endeavors to assess the multifaceted landscape of mortgage debt-backed derivatives, shedding light on the opportunities they present and the challenges they entail.

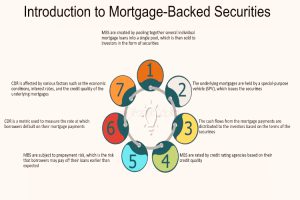

Mortgage debt-backed derivatives, also known as mortgage-backed securities (MBS), are financial instruments that derive their value from pools of underlying mortgage loans. These securities offer investors exposure to the housing market without the need to directly invest in individual mortgages. The allure of MBS lies in their potential for diversification, income generation, and risk mitigation. Moreover, they play a vital role in providing liquidity to the housing market, thereby facilitating homeownership and economic growth.

However, the landscape of mortgage debt-backed derivatives is not devoid of challenges. The 2008 global financial crisis cast a glaring spotlight on the risks inherent in these securities, as the collapse of subprime mortgage-backed derivatives precipitated a widespread market meltdown. Since then, regulatory reforms and risk management practices have sought to enhance the resilience of MBS markets. Nonetheless, concerns persist regarding the potential for systemic risk, the intricacies of valuation methodologies, and the implications of monetary policy shifts on MBS performance.

Against this backdrop, this article will delve into the current state of mortgage debt-backed derivatives, exploring the opportunities they offer for investors seeking yield in a low-interest-rate environment, as well as the challenges posed by economic uncertainties and regulatory complexities. By providing a comprehensive assessment, we aim to equip stakeholders with the knowledge needed to navigate this dynamic landscape effectively.

Opportunities in Mortgage Debt-Backed Derivatives

- Diversification Potential:

Mortgage debt-backed derivatives offer investors a means to diversify their portfolios beyond traditional asset classes such as stocks and bonds. By gaining exposure to the housing market, investors can reduce overall portfolio risk and enhance returns through asset allocation strategies.

- Yield Generation:

In today’s low-interest-rate environment, mortgage debt-backed derivatives present an attractive opportunity for investors seeking higher yields. These securities often offer competitive returns compared to other fixed-income investments, making them appealing to income-oriented investors.

- Tailored Risk Profiles:

With a variety of mortgage debt-backed derivatives available, investors can tailor their exposure to match their risk preferences. From agency-backed MBS with government guarantees to non-agency MBS with higher potential returns but increased credit risk, investors can choose the securities that best align with their risk-return objectives.

- Liquidity and Market Efficiency:

Mortgage debt-backed derivatives contribute to liquidity in the housing market by providing a mechanism for investors to buy and sell exposure to mortgage loans. This liquidity enhances market efficiency and supports the functioning of the broader financial system.

Challenges and Considerations

- Interest Rate Sensitivity:

Mortgage debt-backed derivatives are highly sensitive to changes in interest rates, as fluctuations can impact mortgage prepayment rates and the valuation of MBS. Investors must carefully manage interest rate risk to mitigate potential losses in a rising rate environment.

- Credit and Prepayment Risk:

Non-agency mortgage-backed securities carry inherent credit risk, as they are exposed to the creditworthiness of underlying borrowers. Additionally, prepayment risk poses challenges for investors, as changes in borrower behavior can affect the expected cash flows of MBS.

- Regulatory and Policy Uncertainty:

Regulatory changes and government policy decisions can significantly impact the performance of mortgage debt-backed derivatives. Investors must stay informed about regulatory developments and anticipate the potential implications for MBS markets.

- Market Volatility and Liquidity Concerns:

Mortgage debt-backed derivatives may experience periods of heightened volatility and reduced liquidity, particularly during times of economic uncertainty or financial distress. Investors should be prepared to navigate market fluctuations and assess the liquidity profile of MBS investments.

Regulatory Framework and Compliance Considerations

The regulatory landscape surrounding mortgage debt-backed derivatives is complex and continually evolving. Regulatory agencies such as the Securities and Exchange Commission (SEC) and the Federal Reserve play key roles in overseeing MBS markets and ensuring market integrity. Compliance with regulatory requirements is essential for market participants, as failure to adhere to regulations can result in significant penalties and reputational damage. Moreover, changes in regulatory policies, such as updates to capital requirements or disclosure standards, can impact the profitability and risk profile of mortgage debt-backed derivatives. Market participants must stay abreast of regulatory developments and implement robust compliance frameworks to navigate this challenging regulatory environment effectively.

Technological Innovations and Data Analytics in MBS Markets

Advancements in technology and data analytics have revolutionized the way mortgage debt-backed derivatives are traded, valued, and managed. Fintech solutions and artificial intelligence algorithms enable market participants to analyze vast amounts of data more efficiently, gaining valuable insights into mortgage loan performance and market trends. Machine learning models can enhance risk management practices by identifying patterns and correlations in MBS data, enabling investors to make more informed investment decisions. Additionally, blockchain technology holds the potential to streamline transaction processes and enhance transparency in MBS markets, reducing operational inefficiencies and mitigating counterparty risk. Embracing technological innovations and leveraging data analytics capabilities can provide a competitive advantage for market participants in the increasingly digitized landscape of mortgage debt-backed derivatives.

Conclusion:

The landscape of mortgage debt-backed derivatives presents a dynamic interplay of opportunities and challenges for investors, policymakers, and financial institutions. Despite the inherent complexities and risks associated with these securities, there are compelling opportunities for investors to diversify portfolios, generate yield, and manage risk effectively. The liquidity provided by mortgage debt-backed derivatives contributes to the functioning of the housing market and the broader financial system, supporting economic growth and homeownership.

However, navigating the landscape of mortgage debt-backed derivatives requires careful consideration of various challenges, including interest rate sensitivity, credit and prepayment risk, regulatory compliance, market volatility, and ESG considerations. Market participants must stay vigilant in monitoring regulatory developments, leveraging technological innovations, and integrating ESG factors into their investment processes to mitigate risks and seize opportunities effectively.

Ultimately, a nuanced understanding of the opportunities and challenges inherent in mortgage debt-backed derivatives is essential for informed decision-making and successful portfolio management. By adopting a comprehensive approach that balances risk and reward considerations, investors can harness the potential of mortgage debt-backed derivatives to enhance returns, achieve diversification, and contribute to sustainable financial markets. As MBS markets continue to evolve, ongoing vigilance and adaptability will be key to navigating the ever-changing landscape of mortgage debt-backed derivatives successfully.

Disclaimer: “This article is for educational & entertainment purposes.”