Decoding Success: The Business Entity Code Demystified

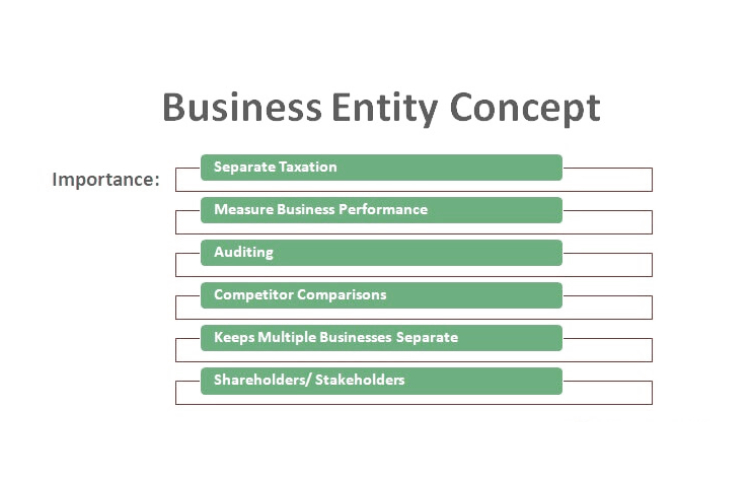

In the complex landscape of business, understanding the intricacies of legal structures and organizational frameworks is paramount to success. In this comprehensive exploration, we embark on a journey to unravel the enigmatic world of business entities, shedding light on their significance and impact. A business entity code serves as the foundational blueprint for any venture, […]

Decoding Success: The Business Entity Code Demystified Read More »