In the complex landscape of business, understanding the intricacies of legal structures and organizational frameworks is paramount to success. In this comprehensive exploration, we embark on a journey to unravel the enigmatic world of business entities, shedding light on their significance and impact.

In the complex landscape of business, understanding the intricacies of legal structures and organizational frameworks is paramount to success. In this comprehensive exploration, we embark on a journey to unravel the enigmatic world of business entities, shedding light on their significance and impact.

A business entity code serves as the foundational blueprint for any venture, dictating its structure, governance, and legal obligations. From sole proprietorships and partnerships to corporations and limited liability companies, each entity type carries distinct advantages and disadvantages, shaping the trajectory of enterprises in profound ways. Yet, navigating this maze of options can often confound even the most seasoned entrepreneurs.

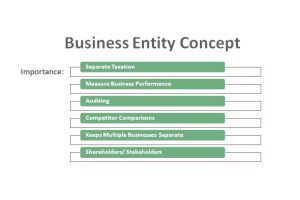

Through meticulous examination and expert analysis, we peel back the layers of complexity surrounding business entity codes, illuminating key considerations for aspiring business owners and seasoned executives alike. From tax implications and liability protections to operational flexibility and regulatory compliance, we uncover the strategic implications inherent in choosing the right entity structure.

Join us as we demystify the business entity code, empowering you to make informed decisions that lay the groundwork for sustainable growth and enduring success. Let’s embark on this transformative journey together, unlocking the secrets to entrepreneurial triumph in the dynamic world of business.

Understanding the Landscape: A Multifaceted World of Business Entities

Exploring the Spectrum: From Sole Proprietorships to Corporations

The landscape of business entities is vast and diverse, offering a spectrum of options to suit the needs and ambitions of entrepreneurs. At one end of the spectrum lies the simplicity of a sole proprietorship, where an individual operates their business as an extension of themselves, bearing full personal liability for its debts and obligations. On the other end stand the formidable structures of corporations, characterized by distinct legal personhood, limited liability, and complex governance mechanisms. Between these poles lie partnerships, limited liability companies (LLCs), and various hybrid entities, each with its own unique features and trade-offs.

Unveiling the Advantages and Disadvantages

Every business entity type comes with its own set of advantages and disadvantages, shaping the decision-making process for entrepreneurs. Sole proprietorships, for instance, offer simplicity and autonomy but expose owners to unlimited personal liability. Partnerships facilitate collaboration and shared decision-making but entail joint liability among partners. Corporations provide limited liability protection and access to capital markets but are subject to greater regulatory scrutiny and administrative complexity. Understanding these trade-offs is crucial for entrepreneurs seeking to align their choice of entity with their strategic objectives and risk tolerance.

Navigating the Maze: Key Considerations in Entity Selection

Legal and Tax Implications

One of the foremost considerations in entity selection is the legal and tax implications associated with each entity type. Sole proprietorships and partnerships are typically treated as pass-through entities for tax purposes, with profits and losses flowing directly to the owners’ personal tax returns. Corporations, on the other hand, are subject to double taxation, with income taxed at both the corporate and individual levels. LLCs offer a flexible tax structure, allowing owners to choose between pass-through taxation or corporate taxation, depending on their preferences and circumstances.

Liability Protection

Limited liability protection is a paramount concern for many entrepreneurs, particularly those operating in high-risk industries or facing significant potential liabilities. Corporations and LLCs offer robust liability protection, shielding owners’ personal assets from business debts and legal claims. In contrast, sole proprietorships and general partnerships expose owners to unlimited personal liability, putting their personal assets at risk in the event of business insolvency or litigation. Understanding the implications of different entity types for liability protection is essential for mitigating risk and safeguarding personal assets.

Operational Flexibility

The level of operational flexibility afforded by different entity types can significantly impact a business’s ability to adapt and evolve over time. Sole proprietorships and partnerships offer simplicity and autonomy, with minimal formalities and administrative requirements. Corporations and LLCs, while subject to greater regulatory oversight, provide enhanced flexibility in areas such as ownership structure, management, and capital raising. Entrepreneurs must weigh the trade-offs between operational flexibility and regulatory compliance when selecting an entity type that aligns with their growth plans and organizational needs.

Empowering Entrepreneurs with Informed Choices

In the dynamic world of business, the choice of entity is not merely a legal formality but a strategic decision with far-reaching implications. By understanding the nuances of business entity codes and carefully evaluating the advantages and disadvantages of different structures, entrepreneurs can position themselves for success and navigate the complexities of the business landscape with confidence. Decoding Success equips entrepreneurs with the knowledge and insights needed to make informed choices that lay the foundation for sustainable growth and prosperity. Join us in unlocking the secrets to entrepreneurial triumph and charting a course towards a brighter future in the ever-changing world of business.

Embarking on the venture with clarity and purpose

With a firm grasp of the intricacies surrounding business entity codes, entrepreneurs can embark on their ventures with clarity and purpose. Armed with knowledge, they can confidently navigate the maze of legal structures, choosing the entity type that best aligns with their goals and aspirations. Whether seeking simplicity and autonomy or prioritizing liability protection and operational flexibility, informed decision-making empowers entrepreneurs to chart a course towards success. The Business Entity Code Demystified serves as a beacon of guidance, illuminating the path to entrepreneurial achievement in a world brimming with opportunity and complexity.

Conclusion

In conclusion, “Decoding Success: The Business Entity Code Demystified” illuminates the critical importance of understanding business entity codes in navigating the entrepreneurial journey. By unraveling the complexities of legal structures and organizational frameworks, entrepreneurs are empowered to make informed decisions that align with their strategic objectives and risk tolerance. Armed with this knowledge, they can confidently navigate the intricate landscape of business, mitigating risks, maximizing opportunities, and charting a course towards sustainable growth and prosperity. As a trusted resource, this guide equips entrepreneurs with the insights and tools needed to decode the secrets of success, inspiring confidence and guiding them towards a brighter future in the dynamic world of business.

Disclaimer: “This article is for educational & entertainment purposes.”