In the bustling world of finance, where fortunes are made and lost in the blink of an eye, there exists a silent language that speaks volumes to those initiated in its nuances. At the heart of this language lies a series of symbols, seemingly mundane yet intricately significant, known as market trading symbols. These symbols, often reduced to a few characters or letters, are the gateway to a complex network of global financial transactions, serving as the foundation upon which the modern stock market operates.

In the bustling world of finance, where fortunes are made and lost in the blink of an eye, there exists a silent language that speaks volumes to those initiated in its nuances. At the heart of this language lies a series of symbols, seemingly mundane yet intricately significant, known as market trading symbols. These symbols, often reduced to a few characters or letters, are the gateway to a complex network of global financial transactions, serving as the foundation upon which the modern stock market operates.

In this exploration, we embark on a journey behind the scenes of the financial world, delving into the significance of these seemingly cryptic codes. Beyond their surface appearance lies a wealth of information, encapsulating the essence of the companies they represent, the exchanges they trade on, and the dynamics of supply and demand that drive their value.

Understanding the importance of market trading symbols is akin to deciphering a secret code that unlocks the doors to financial markets worldwide. From the iconic blue-chip stocks of the New York Stock Exchange (NYSE) to the tech-savvy darlings of the NASDAQ, each symbol tells a story of innovation, growth, and sometimes, volatility.

Moreover, market trading symbols serve as the cornerstone of communication in the fast-paced realm of trading, enabling investors to swiftly identify and execute transactions with precision and efficiency. Whether it’s through the familiar tickers scrolling across financial news channels or the digital interfaces of online trading platforms, these symbols serve as beacons of opportunity in a sea of economic data.

Join us as we peel back the layers of obscurity surrounding market trading symbols, uncovering their significance and unraveling the mysteries of the global financial landscape.

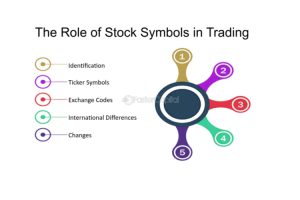

The Anatomy of Market Trading Symbols

Ticker Symbols:

These are typically short alphabetic codes assigned to publicly traded companies, representing their stocks on various exchanges. For instance, “AAPL” signifies Apple Inc. on the NASDAQ exchange.

Stock Exchanges:

Different exchanges have their own sets of rules for assigning trading symbols. Understanding these conventions is crucial for investors navigating diverse markets.

International Considerations:

Market trading symbols aren’t confined to a single country. As companies go global, their symbols may differ across exchanges, requiring investors to grasp the intricacies of cross-border trading.

Deciphering the Information Within Symbols

Company Information:

Market trading symbols often encode information about the companies they represent. For instance, certain letters might denote the company’s industry or status (e.g., “B” for banking, “P” for preferred shares).

Market Dynamics:

Symbols can reflect market sentiment and performance. Changes in a symbol’s trading volume, for instance, may indicate shifts in investor interest or market volatility.

Symbol Evolution:

Symbols aren’t static; they can change over time due to corporate actions like mergers, acquisitions, or rebranding efforts. Investors must stay informed to avoid confusion or misinterpretation.

The Role of Market Trading Symbols in Market Analysis

Market trading symbols play a pivotal role in market analysis, serving as vital data points for investors and analysts alike. By monitoring the performance of specific symbols over time, analysts can identify trends, assess market sentiment, and make informed predictions about future price movements. For instance, tracking changes in a company’s trading symbol’s volume or price-to-earnings ratio can provide valuable insights into its growth potential and overall market health. Moreover, comparative analysis of symbols within the same industry or sector can help investors gauge relative strength and identify potential investment opportunities or risks.

Additionally, market trading symbols serve as key components in technical analysis, where chart patterns and historical price data are used to forecast future price movements. Analysts often rely on symbols’ trading histories and patterns to identify support and resistance levels, trend reversals, and other important signals. By incorporating symbols’ historical performance into their analysis, investors can develop more robust trading strategies and improve their chances of success in the dynamic world of finance.

Regulatory Framework and Compliance Considerations

Behind every market trading symbol lies a complex web of regulatory requirements and compliance standards designed to ensure transparency, fairness, and integrity in financial markets. Regulatory bodies such as the Securities and Exchange Commission (SEC) in the United States impose strict guidelines for the assignment and usage of trading symbols to prevent fraud, manipulation, and market abuse. Companies seeking to list their securities on public exchanges must adhere to these regulations, including disclosing relevant information about their operations, financial condition, and corporate governance practices.

Moreover, exchanges themselves play a crucial role in maintaining market integrity by enforcing listing requirements and monitoring trading activities. Exchanges like the NYSE and NASDAQ establish standards for symbol eligibility, minimum trading volumes, and reporting obligations to safeguard investors’ interests and maintain orderly market operations. Compliance with these standards not only ensures market transparency and investor protection but also fosters trust and confidence in the financial system as a whole.

Conclusion:

In the intricate tapestry of financial markets, market trading symbols serve as the unsung heroes, silently communicating volumes of information to those who understand their significance. Through this exploration, we’ve peeled back the layers surrounding these symbols, revealing their profound importance in the world of finance.

From their role in identifying companies and facilitating transactions to their utilization in market analysis and regulatory compliance, market trading symbols are the bedrock upon which the global financial system is built. They encapsulate the essence of companies, industries, and market dynamics, providing investors with valuable insights and opportunities for informed decision-making.

As we navigate the complexities of modern finance, it becomes increasingly clear that understanding market trading symbols is not just a matter of convenience but a necessity for success. Whether you’re a seasoned investor, a budding trader, or simply curious about the inner workings of financial markets, delving into the significance of market trading symbols offers a deeper appreciation for the intricacies of our economic landscape.

In an era of rapid technological innovation and evolving market dynamics, the significance of market trading symbols will only continue to grow. As such, staying informed, adaptable, and vigilant in deciphering the language of symbols is essential for navigating the ever-changing currents of finance with confidence and clarity. So, let us continue to explore, decode, and uncover the secrets behind the scenes of market trading symbols, for therein lies the key to unlocking the mysteries of the financial world.

Disclaimer: “This article is for educational & entertainment purposes.”