In the world of financial transactions, security is paramount. Every time a credit or debit card is swiped or entered into an online payment system, a complex process unfolds behind the scenes to verify the legitimacy of the transaction. At the heart of this process lies the Issuer Identification System (IIS), a foundational component of card authentication that ensures the integrity and safety of electronic payments.

In the world of financial transactions, security is paramount. Every time a credit or debit card is swiped or entered into an online payment system, a complex process unfolds behind the scenes to verify the legitimacy of the transaction. At the heart of this process lies the Issuer Identification System (IIS), a foundational component of card authentication that ensures the integrity and safety of electronic payments.

This article explores the intricate workings of IIS, shedding light on its significance in the modern landscape of financial security. This article aims to provide a comprehensive understanding of IIS, from its fundamental principles to its practical applications in safeguarding transactions against fraud and unauthorized access.

At its core, the Issuer Identification System serves as a critical mechanism for identifying the origin and validity of payment cards. Every card carries a unique identification number known as the Bank Identification Number (BIN), which is assigned to specific financial institutions or card issuers. Through the utilization of BINs, IIS facilitates the verification of card authenticity and affiliation with authorized issuers.

Furthermore, this article explores the sophisticated algorithms and databases utilized within IIS to cross-reference BINs with extensive repositories of issuer information. By leveraging these resources, IIS can swiftly authenticate transactions in real time, mitigating the risk of fraudulent activities and ensuring the seamless flow of commerce.

As electronic payments continue to proliferate in the digital age, the importance of robust authentication mechanisms like IIS cannot be overstated. Through a nuanced examination of its principles and functionalities,

Anatomy of the Issuer Identification System

- Bank Identification Numbers (BINs):BINs serve as the cornerstone of the Issuer Identification System, providing a unique numerical identifier for each card issuer or financial institution. These numbers, typically comprising the first six digits of a payment card, enable rapid identification of the issuing entity.

- Issuer Identification Algorithms:Behind the scenes, sophisticated algorithms are employed to validate and process BINs. These algorithms utilize checksums, prefix ranges, and other validation techniques to ensure the integrity and authenticity of the identification process.

- Issuer Databases:Issuer Identification Systems rely on extensive databases containing information about authorized card issuers and their corresponding BINs. These databases are continuously updated to reflect changes in the industry, such as new issuers or revised BIN assignments.

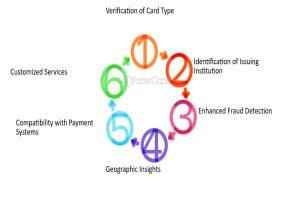

Functionality and Applications of the Issuer Identification System

- Real-Time Transaction Verification:

One of the primary functions of the Issuer Identification System is to verify the legitimacy of transactions in real-time. By cross-referencing the BIN of a payment card with issuer databases, IIS can swiftly authenticate transactions, reducing the risk of fraud and unauthorized access.

- Fraud Detection and Prevention:

IIS plays a crucial role in detecting and preventing fraudulent activities within the realm of electronic payments. By flagging suspicious transactions or discrepancies in BIN data, IIS helps financial institutions and payment processors identify potential security threats and take proactive measures to mitigate risks.

- Enhanced Security Protocols:

Through its integration with security protocols such as 3-D Secure (3DS) and Address Verification System (AVS), the Issuer Identification System contributes to the implementation of multi-layered security measures in online transactions. These protocols add an extra layer of authentication, further fortifying the security of electronic payments.

- Global Compatibility and Interoperability:

IIS is designed to be globally compatible, allowing seamless interoperability across different payment networks and regions. Whether it’s a domestic transaction or an international purchase, the Issuer Identification System ensures consistent and reliable authentication, regardless of geographic boundaries.

Evolving Technologies and Innovations in Issuer Identification Systems

As technology continues to advance, Issuer Identification Systems are also evolving to meet the changing demands of the digital landscape. One notable innovation is the integration of machine learning and artificial intelligence (AI) algorithms into IIS platforms. By analyzing vast amounts of transaction data and patterns, AI-powered IIS can enhance fraud detection capabilities, identifying anomalous behaviors with greater accuracy and speed. Additionally, advancements in biometric authentication, such as fingerprint or facial recognition, are being integrated into IIS to add an extra layer of security to cardholder verification processes. These innovations underscore the dynamic nature of Issuer Identification Systems, as they adapt to emerging threats and incorporate cutting-edge technologies to bolster security measures.

Furthermore, the emergence of blockchain technology has the potential to revolutionize the way Issuer Identification Systems operate. Blockchain offers a decentralized and immutable ledger, which could enhance the security and transparency of transaction verification processes within IIS. By leveraging blockchain technology, Issuer Identification Systems can establish a more resilient infrastructure for securely storing and accessing BIN data, reducing the risk of data breaches and unauthorized tampering. Moreover, blockchain-based IIS could facilitate cross-border transactions more efficiently, streamlining the authentication process and enhancing interoperability across diverse payment networks.

Conclusion:

The journey through the intricacies of Issuer Identification Systems (IIS) has provided a profound understanding of the indispensable role they play as the backbone of card authentication. As we navigate the ever-evolving landscape of electronic transactions, the significance of IIS in safeguarding financial integrity and ensuring secure payment processes cannot be overstated.

By unraveling the layers of IIS functionality, from the fundamental principles of Bank Identification Numbers (BINs) to the advanced algorithms and databases that power real-time authentication, we have gained insight into the intricate mechanisms that underpin card security. The synergy of technology and innovation, including the integration of machine learning, AI algorithms, and blockchain, promises to further fortify the resilience of IIS against emerging threats and vulnerabilities.

Moreover, the discussion on regulatory frameworks and compliance underscores the commitment of stakeholders to uphold the highest standards of security and data protection in electronic payments. Compliance with industry standards such as PCI DSS and regulatory oversight from governing bodies ensure that IIS platforms adhere to stringent security protocols, safeguarding cardholder information and maintaining trust in financial systems.

As we reflect on the significance of Issuer Identification Systems, it becomes evident that they serve as a cornerstone of trust and reliability in the digital economy. With ongoing advancements and proactive measures to enhance security, IIS will continue to evolve as a robust defense against fraud and unauthorized access, empowering consumers and businesses to engage in electronic transactions with confidence and peace of mind.

Disclaimer: “This article is for educational & entertainment purposes.”