In the intricate web of global financial markets, where transactions are executed at lightning speed and volumes soar to staggering heights, precision and clarity are paramount. Amidst this complexity, a seemingly humble yet indispensable element plays a pivotal role – the Unique Issuer Identifier (UII). Often overlooked in the cacophony of trading floors and investment strategies, the UII quietly but resolutely serves as the cornerstone of transparency, efficiency, and risk management within financial ecosystems.

In the intricate web of global financial markets, where transactions are executed at lightning speed and volumes soar to staggering heights, precision and clarity are paramount. Amidst this complexity, a seemingly humble yet indispensable element plays a pivotal role – the Unique Issuer Identifier (UII). Often overlooked in the cacophony of trading floors and investment strategies, the UII quietly but resolutely serves as the cornerstone of transparency, efficiency, and risk management within financial ecosystems.

This article is on a journey to unravel the significance of these seemingly mundane identifiers, shedding light on their profound impact on market operations and regulatory frameworks worldwide. At its core, this exploration seeks to demystify the role of UIIs and elucidate their implications for stakeholders ranging from investors and traders to regulators and policymakers.

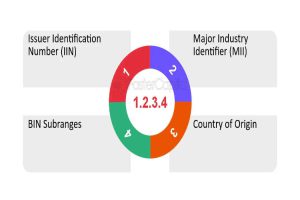

A Unique Issuer Identifier serves as a digital fingerprint, uniquely identifying entities issuing financial instruments such as stocks, bonds, and derivatives. While seemingly straightforward, the implementation and standardization of UIIs represent a monumental achievement in the realm of financial infrastructure. By providing a universal means of identification, UIIs facilitate seamless communication and data exchange across disparate platforms, fostering interoperability and reducing operational inefficiencies.

Furthermore, the importance of UIIs transcends mere administrative convenience; they form the bedrock of risk management strategies, enabling institutions to accurately assess counterparty exposure and monitor systemic vulnerabilities. Moreover, in an era characterized by heightened regulatory scrutiny and the proliferation of compliance requirements, UIIs emerge as indispensable tools for ensuring adherence to regulatory frameworks such as the Legal Entity Identifier (LEI) system.

The Evolution and Standardization of Unique Issuer Identifiers

- Origins:Tracing the historical development of UIIs, from early attempts at standardization to the emergence of global frameworks.

- Challenges:Exploring the hurdles encountered in achieving universal adoption of UIIs, including issues of interoperability, data quality, and governance.

- LEI System:Delving into the establishment and evolution of the Legal Entity Identifier (LEI) system as a cornerstone of UII standardization efforts.

- Global Implementation:Examining the diverse approaches taken by regulatory bodies and industry stakeholders worldwide to integrate UIIs into their operational frameworks.

The Role of Unique Issuer Identifiers in Financial Markets

- Transparency and Efficiency:

Highlighting how UIIs enhance market transparency by providing unique identification for entities issuing financial instruments, thereby facilitating more efficient price discovery and trading processes.

- Risk Management:

Illustrating the critical role of UIIs in enabling accurate assessment of counterparty exposure, enhancing risk management practices, and bolstering systemic resilience.

- Regulatory Compliance:

Discussing the pivotal importance of UIIs in meeting regulatory mandates, such as those outlined in the LEI system, and ensuring adherence to reporting requirements and compliance standards.

- Data Integration and Interoperability:

Exploring how UIIs enable seamless data exchange and integration across disparate systems and platforms, fostering interoperability and streamlining operational workflows.

The Impact of Unique Issuer Identifiers on Investor Confidence and Market Integrity

Enhanced Trust: With the implementation of UIIs, investors gain greater confidence in the transparency and accuracy of financial data. By providing a standardized means of identifying issuers, UIIs reduce the risk of confusion or ambiguity in investment decisions, thereby bolstering investor trust in the integrity of financial markets. This increased confidence can lead to improved market liquidity and efficiency as investors are more willing to participate in trading activities, knowing that the underlying entities are accurately identified and regulated.

Market Integrity: UIIs play a crucial role in preserving market integrity by enabling regulators and market participants to track and monitor the activities of entities issuing financial instruments. Through the use of UIIs, regulators can more effectively detect and prevent fraudulent or manipulative behavior, thereby safeguarding the interests of investors and maintaining the overall integrity of financial markets. Additionally, UIIs facilitate the enforcement of regulatory requirements such as reporting obligations and transaction monitoring, contributing to a more transparent and orderly marketplace that fosters fair and equitable trading practices.

Addressing Challenges and Future Considerations for Unique Issuer Identifiers

Data Quality and Governance: Despite their many benefits, UIIs are not without challenges, particularly concerning data quality and governance. Ensuring the accuracy and reliability of UII data requires robust governance frameworks and mechanisms for data validation and verification. Additionally, ongoing efforts are needed to address issues such as data duplication and inconsistencies across different data sources, which can undermine the effectiveness of UIIs in facilitating accurate identification and risk assessment.

Global Adoption and Standardization: Achieving universal adoption and standardization of UIIs remains a key challenge for the financial industry. While significant progress has been made, particularly through initiatives such as the LEI system, disparities in regulatory requirements and implementation approaches across jurisdictions continue to pose obstacles to seamless integration and interoperability. Moving forward, greater collaboration and coordination among regulatory authorities, industry stakeholders, and standards-setting bodies will be essential to overcoming these challenges and establishing a truly global framework for unique issuer identification.

Conclusion:

In the labyrinthine world of financial markets, where every transaction carries profound implications and every decision reverberates across global economies, the significance of Unique Issuer Identifiers (UIIs) cannot be overstated. Through our journey of “Decoding Unique Issuer Identifiers: Understanding Their Importance in Financial Markets,” we have illuminated the pivotal role that UIIs play in shaping the dynamics of modern finance.

From their humble origins to their evolution as indispensable tools for transparency, risk management, and regulatory compliance, UIIs have emerged as the unsung heroes of financial infrastructure. They serve as the bedrock upon which market integrity, investor confidence, and regulatory oversight are built, providing a universal language that transcends borders and boundaries.

As we reflect on the myriad ways in which UIIs enhance the efficiency and resilience of financial markets, it becomes clear that their importance extends far beyond mere administrative convenience. They are catalysts for innovation, enablers of trust, and guardians of market integrity. Yet, challenges remain on the horizon, from ensuring data quality and governance to achieving universal adoption and standardization.

Looking ahead, we must continue to champion the cause of UIIs, recognizing their indispensable role in fostering a more transparent, efficient, and interconnected financial ecosystem. By embracing the principles of collaboration, innovation, and inclusivity, we can unlock the full potential of UIIs and usher in a new era of prosperity and stability for global markets. Together, let us embark on this journey with renewed vigor and determination, harnessing the power of UIIs to navigate the complexities of financial markets with clarity, confidence, and conviction.

Disclaimer: “This article is for educational & entertainment purposes.”