In the ever-evolving landscape of finance, identifying optimal securities combinations for a well-rounded portfolio is akin to finding the perfect blend of ingredients for a gourmet dish – it requires expertise, precision, and a keen understanding of the individual components. As investors seek to maximize returns while minimizing risk, the importance of crafting a diversified portfolio tailored to their specific objectives becomes increasingly paramount.

In the ever-evolving landscape of finance, identifying optimal securities combinations for a well-rounded portfolio is akin to finding the perfect blend of ingredients for a gourmet dish – it requires expertise, precision, and a keen understanding of the individual components. As investors seek to maximize returns while minimizing risk, the importance of crafting a diversified portfolio tailored to their specific objectives becomes increasingly paramount.

The art of identifying optimal securities combinations lies at the heart of portfolio management, offering investors the opportunity to achieve their financial goals while mitigating exposure to market volatility. Whether it’s stocks, bonds, mutual funds, or alternative investments, the key lies in strategically combining these assets to create a balanced and resilient portfolio.

In this comprehensive guide, we delve into the intricate process of identifying and constructing optimal securities combinations, equipping investors with the knowledge and tools necessary to navigate the complexities of the financial markets with confidence. From understanding the fundamental principles of asset allocation to employing advanced quantitative techniques, we explore a range of strategies designed to optimize portfolio performance across various market conditions.

Whether you’re a seasoned investor looking to fine-tune your asset allocation strategy or a novice seeking to build a diversified portfolio from scratch, this guide serves as a roadmap to identifying optimal securities combinations that align with your investment goals. Join us as we embark on a journey to unlock the potential of your portfolio and navigate the complexities of the financial markets with precision and insight.

Understanding Asset Allocation Principles

- Diversification: Explaining the importance of spreading investments across different asset classes, such as stocks, bonds, and cash equivalents.Discussing how diversification can reduce overall portfolio risk by minimizing the impact of individual asset performance.

- Risk Tolerance Assessment: Providing methodologies for investors to assess their risk tolerance, considering factors like investment objectives, time horizon, and personal financial circumstances. Offering guidance on aligning asset allocation decisions with risk tolerance to create a balanced portfolio suited to individual preferences.

- Correlation Analysis: Introducing correlation as a measure of how closely related the returns of two assets are. Exploring how correlation analysis can help identify assets that behave differently under various market conditions, enhancing portfolio diversification.

Advanced Strategies for Securities Combination Identification

- Modern Portfolio Theory (MPT):

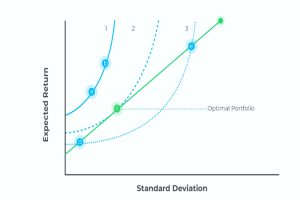

Discussing the principles of MPT, pioneered by Harry Markowitz, which emphasizes maximizing returns for a given level of risk.

Exploring the efficient frontier and how it assists in identifying optimal securities combinations that offer the highest expected return for a given level of risk.

- Factor Investing:

Introducing factor investing as a strategy that seeks to capture specific drivers of asset returns, such as value, momentum, and quality.

Discussing how factor investing can enhance portfolio diversification and potentially improve risk-adjusted returns by targeting sources of systematic risk.

- Monte Carlo Simulation:

Explaining how Monte Carlo simulation models multiple possible outcomes by introducing randomness into the analysis.

Illustrating how Monte Carlo simulation can be used to assess the potential performance of different securities combinations under various market scenarios, aiding in decision-making and risk management.

Tactical Asset Allocation Techniques

Tactical asset allocation involves adjusting portfolio allocations based on short-term market outlooks and economic trends. This strategy aims to capitalize on near-term opportunities or mitigate potential risks within the investment landscape. One tactical approach is sector rotation, where investors allocate assets to sectors expected to outperform in the current market environment while reducing exposure to underperforming sectors. Another technique is market timing, which involves adjusting asset allocations based on signals from technical analysis, economic indicators, or market sentiment. While tactical asset allocation can potentially enhance returns, it requires active monitoring and may involve higher transaction costs.

Dynamic Risk Management Strategies

Dynamic risk management strategies aim to protect portfolios during periods of heightened volatility or market downturns. One such approach is the use of options, such as put options or collars, to hedge against downside risk. These strategies allow investors to limit potential losses while maintaining exposure to potential upside gains. Additionally, dynamic asset allocation involves adjusting portfolio weights in response to changing market conditions, such as reducing equity exposure during periods of market stress. By incorporating dynamic risk management strategies, investors can better navigate uncertain market environments and protect their portfolios from significant downturns.

Alternative Investments and Portfolio Diversification

Alternative investments, such as real estate, commodities, and private equity, offer unique risk-return characteristics that can complement traditional asset classes. Including alternative investments in a portfolio can enhance diversification and reduce overall portfolio risk, as their returns may have a low correlation with those of stocks and bonds. However, alternative investments often have longer investment horizons, lower liquidity, and higher fees compared to traditional assets. Therefore, investors should carefully consider their objectives and risk tolerance before incorporating alternative investments into their portfolios. Despite these challenges, alternative investments can provide opportunities for enhanced returns and portfolio diversification when used judiciously within a well-constructed investment strategy.

Conclusion:

In the world of investment, the pursuit of optimal securities combinations for one’s portfolio is not merely a quest for financial gain, but a journey towards achieving one’s long-term objectives while navigating the ever-changing tides of the market. Through the principles outlined in this guide, investors have gained insight into the art and science of portfolio construction, understanding that the selection and allocation of assets are not arbitrary decisions, but deliberate strategies aimed at balancing risk and return.

As we conclude our exploration into identifying optimal securities combinations, it’s imperative to recognize that the journey does not end here. The financial markets are dynamic and multifaceted, presenting new challenges and opportunities with each passing day. Thus, the knowledge and methodologies shared in this guide serve as a foundation upon which investors can continue to build and refine their investment strategies, adapting to changing market conditions and evolving investment landscapes.

Ultimately, the pursuit of optimal securities combinations is a deeply personal endeavor, shaped by individual goals, preferences, and risk appetites. It requires a blend of analytical rigor, informed decision-making, and perhaps a touch of intuition. By embracing the principles discussed herein and remaining steadfast in their commitment to disciplined investing, investors can navigate the complexities of the financial markets with confidence, knowing that they have equipped themselves with the tools and insights necessary to construct resilient and prosperous portfolios.

In this journey toward financial success, may diligence be your compass, diversification your shield, and wisdom your guiding light. Here’s to unlocking the full potential of your portfolio and realizing your investment aspirations.

Disclaimer: “This article is for educational & entertainment purposes.”