In the ever-evolving landscape of investment, where uncertainty looms large and risk mitigation is paramount, leveraging comprehensive analysis becomes the cornerstone of informed decision-making. Within this realm, securitized loan performance analysis stands out as a pivotal tool, offering deep insights into the dynamics of financial markets and the resilience of underlying assets. This article delves into the strategic importance of securitized loan performance analysis and its implications for shaping effective investment strategies.

In the ever-evolving landscape of investment, where uncertainty looms large and risk mitigation is paramount, leveraging comprehensive analysis becomes the cornerstone of informed decision-making. Within this realm, securitized loan performance analysis stands out as a pivotal tool, offering deep insights into the dynamics of financial markets and the resilience of underlying assets. This article delves into the strategic importance of securitized loan performance analysis and its implications for shaping effective investment strategies.

Securitized loans, comprising diverse assets bundled together to create investment products such as mortgage-backed securities (MBS) and asset-backed securities (ABS), have gained prominence in the global financial markets. The performance of these securities is intricately linked to underlying loans, ranging from residential mortgages and auto loans to commercial real estate debt. As such, understanding the nuances of securitized loan performance is crucial for investors seeking to navigate the complexities of structured finance.

At the heart of effective investment strategies lies the ability to assess risk and identify opportunities for generating returns. Securitized loan performance analysis provides investors with a comprehensive framework for evaluating the creditworthiness of underlying assets, assessing default probabilities, and gauging potential cash flow streams. By scrutinizing historical data and employing sophisticated modeling techniques, investors can gain a deeper understanding of the factors driving performance trends and anticipate future market movements.

Moreover, in an era marked by heightened volatility and economic uncertainty, the importance of robust risk management cannot be overstated. Securitized loan performance analysis equips investors with the tools to conduct stress testing scenarios, evaluate the impact of macroeconomic factors on asset performance, and construct resilient portfolios capable of weathering market turbulence.

Understanding the Components of Securitized Loan Performance Analysis

- Asset Quality Assessment:

Analyzing the credit quality of underlying loans is fundamental to assessing securitized loan performance. This involves evaluating factors such as borrower credit scores, loan-to-value ratios, and historical delinquency rates. By examining these metrics, investors can gauge the likelihood of default and potential losses within the securitized pool.

- Cash Flow Analysis:

Assessing the cash flow dynamics of securitized loans is essential for estimating future income streams and assessing investment viability. This entails examining factors such as prepayment speeds, loan maturity profiles, and yield-to-maturity calculations. Understanding these components allows investors to forecast cash flows accurately and optimize portfolio returns.

- Risk Sensitivity Testing:

Conducting sensitivity analysis is critical for evaluating the resilience of securitized loan portfolios to various economic scenarios. Investors utilize stress testing techniques to assess the impact of adverse conditions, such as changes in interest rates, unemployment rates, and housing market dynamics, on asset performance. By simulating different scenarios, investors can identify vulnerabilities and implement risk mitigation strategies proactively.

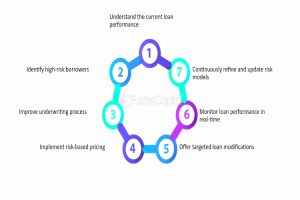

Implementing Investment Strategies Based on Securitized Loan Performance Analysis

- Selective Asset Allocation:

Utilizing insights from securitized loan performance analysis, investors can strategically allocate capital across different asset classes and sectors. By identifying sectors with favorable risk-return profiles and strong underlying fundamentals, investors can optimize portfolio diversification and enhance long-term returns.

- Active Portfolio Management:

Implementing an active management approach enables investors to capitalize on emerging market trends and exploit inefficiencies within securitized loan markets. This involves continuously monitoring performance metrics, adjusting portfolio allocations based on market dynamics, and actively managing risk exposures to maximize returns while mitigating downside risk.

- Diversification Strategies:

Employing diversification strategies is crucial for managing risk and enhancing portfolio stability. Investors can achieve diversification by investing in a broad range of securitized assets across different geographic regions, asset classes, and credit profiles. By spreading risk across a diverse set of securities, investors can reduce correlation and minimize the impact of adverse events on portfolio performance.

Leveraging Technology for Enhanced Analysis

Incorporating advanced technological tools and data analytics techniques can significantly enhance the effectiveness of securitized loan performance analysis. Utilizing machine learning algorithms and predictive modeling, investors can extract valuable insights from vast datasets, identify patterns, and forecast future performance trends with greater accuracy. Additionally, employing data visualization techniques allows investors to communicate complex analysis results clearly and concisely, facilitating informed decision-making processes. By leveraging technology-driven solutions, investors can streamline the analysis process, uncover hidden opportunities, and gain a competitive edge in the dynamic world of structured finance.

Evaluating Environmental, Social, and Governance (ESG) Factors

The integration of environmental, social, and governance (ESG) factors into securitized loan performance analysis is gaining prominence as investors increasingly recognize the importance of sustainable investing practices. Assessing ESG risks and opportunities allows investors to evaluate the long-term viability and resilience of securitized assets in the face of evolving environmental and social challenges. By incorporating ESG considerations into investment decision-making processes, investors can align their portfolios with their values, mitigate reputational risks, and contribute to positive social and environmental outcomes. Furthermore, integrating ESG criteria into risk assessment frameworks enables investors to identify potential material risks and opportunities that traditional financial metrics may overlook, thus enhancing the overall sustainability and resilience of investment portfolios.

Conclusion:

The utilization of securitized loan performance analysis as a cornerstone for investment strategies unveils a pathway toward informed decision-making and optimized portfolio management in the intricate realm of structured finance. By delving into the depths of asset quality assessment, cash flow analysis, and risk sensitivity testing, investors can gain a comprehensive understanding of the underlying dynamics driving securitized loan performance. This understanding empowers investors to identify opportunities, mitigate risks, and construct resilient portfolios capable of weathering market turbulence and delivering sustainable returns over the long term.

Furthermore, the implementation of investment strategies rooted in securitized loan performance analysis necessitates a forward-looking approach that integrates technological advancements, regulatory compliance, and environmental, social, and governance (ESG) considerations. Leveraging technology-driven solutions facilitates data-driven decision-making, enhances analytical capabilities, and unlocks valuable insights from vast datasets. Concurrently, adherence to regulatory requirements and robust risk management practices is essential for maintaining market integrity, safeguarding investor interests, and fostering sustainable growth in securitized loan markets.

As investors navigate the complexities of the investment landscape, the integration of securitized loan performance analysis into investment strategies emerges as a pivotal tool for achieving financial objectives while mitigating risks. By harnessing the power of data-driven insights, embracing technological innovation, and adhering to best practices in risk management and regulatory compliance, investors can navigate the evolving landscape of structured finance with confidence and resilience, ultimately unlocking new avenues for value creation and sustainable growth.

Disclaimer: “This article is for educational & entertainment purposes.”