In the realm of investment opportunities, mortgage-backed notes stand out as a compelling option for investors seeking to diversify their portfolios and maximize returns. These financial instruments, backed by a pool of mortgage loans, offer a unique combination of steady income and potential for capital appreciation. In this comprehensive guide, we delve into the strategies that investors can employ to optimize their returns through mortgage-backed notes.

In the realm of investment opportunities, mortgage-backed notes stand out as a compelling option for investors seeking to diversify their portfolios and maximize returns. These financial instruments, backed by a pool of mortgage loans, offer a unique combination of steady income and potential for capital appreciation. In this comprehensive guide, we delve into the strategies that investors can employ to optimize their returns through mortgage-backed notes.

Mortgage-backed notes are securities that represent an ownership interest in a pool of mortgage loans. These loans are typically residential mortgages, ranging from conventional home loans to government-backed mortgages such as those insured by the Federal Housing Administration (FHA) or guaranteed by the Veterans Administration (VA). The cash flows generated from the underlying mortgage payments serve as the primary source of income for investors in mortgage-backed notes.

One of the key advantages of mortgage-backed notes is their ability to provide consistent cash flows, making them particularly attractive to income-oriented investors. Additionally, these securities offer the potential for higher yields compared to other fixed-income investments, such as Treasury bonds or corporate bonds. However, investors need to understand the intricacies of mortgage-backed securities and implement effective strategies to mitigate risks and enhance returns.

In this article, we will explore various strategies that investors can utilize to maximize returns with mortgage-backed notes. From understanding the different types of mortgage-backed securities to evaluating risk factors and implementing portfolio allocation strategies, we will provide actionable insights to help investors navigate this complex yet rewarding asset class. Whether you’re a seasoned investor looking to enhance your portfolio or a novice seeking to diversify your investments, this guide will equip you with the knowledge and tools necessary to capitalize on the potential of mortgage-backed notes.

Understanding Mortgage-Backed Securities

-

Types of Mortgage-Backed Securities:

- Pass-Through Securities:These securities distribute the principal and interest payments from the underlying mortgages directly to the investors.

- Collateralized Mortgage Obligations (CMOs):CMOs are structured securities that divide the cash flows from the underlying mortgages into separate tranches, each with its own risk and return characteristics.

- Mortgage-Backed Bonds:These securities are backed by a pool of mortgage loans and pay interest and principal according to a predetermined schedule.

-

Factors Affecting Mortgage-Backed Securities:

- Prepayment Risk:Mortgage-backed securities are subject to prepayment risk, which arises when homeowners refinance their mortgages or make extra payments.

- Interest Rate Risk:Changes in interest rates can impact the value of mortgage-backed securities, as they affect the present value of future cash flows.

- Credit Risk:While government-sponsored mortgage-backed securities are backed by the full faith and credit of the U.S. government, private-label mortgage-backed securities carry credit risk associated with the underlying mortgages.

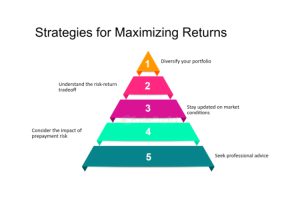

Strategies for Maximizing Returns

Yield Curve Positioning:

- Convexity Play:Investors can take advantage of the convexity of mortgage-backed securities by positioning their portfolios to benefit from changes in interest rates.

- Yield Curve Steepening/Flattening:Depending on the shape of the yield curve, investors can adjust their exposure to mortgage-backed securities to capitalize on yield curve movements.

Sector and Security Selection:

- Agency vs. Non-Agency Securities:Investors can choose between agency mortgage-backed securities, which are guaranteed by government-sponsored entities, and non-agency securities, which carry higher credit risk but potentially higher yields.

- Credit Enhancement Analysis:When investing in non-agency mortgage-backed securities, conducting thorough credit analysis and assessing the quality of credit enhancements can help mitigate credit risk.

Risk Management Techniques

In managing investments in mortgage-backed securities, it’s crucial to employ risk management techniques to safeguard against potential downside risks. One effective approach is diversification across different types of mortgage-backed securities. By spreading investments across various types, such as pass-through securities, CMOs, and mortgage-backed bonds, investors can mitigate exposure to specific risks associated with each type. Additionally, diversifying across different tranches within CMOs can further enhance risk management, as each tranche has its own risk profile and sensitivity to changes in interest rates and prepayment behavior.

Another essential risk management technique is active monitoring and analysis of prepayment and interest rate trends. By closely monitoring macroeconomic factors, such as changes in interest rates, housing market conditions, and borrower behavior, investors can anticipate prepayment patterns and adjust their investment strategies accordingly. Implementing robust analytics and modeling techniques can help identify potential risks and opportunities, enabling investors to make informed decisions to protect their investment portfolios.

Yield Enhancement Strategies

In pursuit of maximizing returns with mortgage-backed securities, investors can explore various yield enhancement strategies to boost portfolio performance. One such strategy is the use of structured products, such as interest-only (IO) and principal-only (PO) securities, which offer unique opportunities to capitalize on specific cash flow streams from mortgage-backed securities. IO securities provide exposure to the interest component of mortgage payments, while PO securities offer exposure to the principal component. By strategically incorporating these structured products into their portfolios, investors can tailor their exposure to different risk factors and optimize yield potential.

Additionally, investors can leverage options strategies, such as mortgage-backed securities swaps and swaptions, to enhance yield and manage risk. These derivative instruments enable investors to hedge against adverse movements in interest rates and capitalize on market inefficiencies. By structuring option-based strategies that align with their investment objectives and risk tolerance, investors can enhance yield potential while protecting their portfolios from downside risks.

Conclusion:

Maximizing returns with mortgage-backed notes requires a combination of thorough understanding, strategic planning, and diligent risk management. Throughout this guide, we have explored various strategies that investors can employ to optimize their investment portfolios and capitalize on the potential of mortgage-backed securities.

By comprehensively understanding the types of mortgage-backed securities available and the factors influencing their performance, investors can make informed decisions tailored to their investment objectives and risk tolerance. Diversification across different types of mortgage-backed securities and careful selection of sectors and securities are essential for mitigating risks and enhancing yield potential.

Moreover, actively monitoring market trends, prepayment behavior, and regulatory developments is crucial for staying ahead of the curve and adapting investment strategies accordingly. Leveraging yield enhancement strategies, such as structured products and options strategies, can further augment portfolio performance and manage risk effectively.

In summary, with careful planning, diligent research, and prudent risk management, investors can unlock the full potential of mortgage-backed notes as a valuable component of a diversified investment portfolio.

Disclaimer: “This article is for educational & entertainment purposes.”