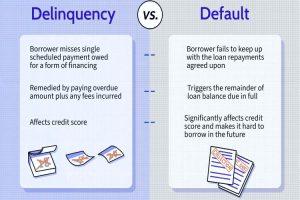

Pool mortgage delinquency and default reporting is a critical aspect of the mortgage-backed securities (MBS) market, offering insights into the health and performance of these investment vehicles. Delinquency refers to when a borrower fails to make a mortgage payment on time, while default occurs when a borrower fails to repay the loan according to the agreed terms. In the context of MBS, pools of mortgages are bundled together and sold to investors as securities. Delinquency and default reporting provide investors with crucial information about the risk associated with these investments.

Pool mortgage delinquency and default reporting is a critical aspect of the mortgage-backed securities (MBS) market, offering insights into the health and performance of these investment vehicles. Delinquency refers to when a borrower fails to make a mortgage payment on time, while default occurs when a borrower fails to repay the loan according to the agreed terms. In the context of MBS, pools of mortgages are bundled together and sold to investors as securities. Delinquency and default reporting provide investors with crucial information about the risk associated with these investments.

Reporting typically includes metrics such as the percentage of mortgages within a pool that are delinquent, the severity of delinquencies (i.e., the length of time payments have been missed), and the foreclosure rate. Investors rely on this data to assess the likelihood of receiving expected returns from their investments. Timely and accurate reporting is essential for maintaining transparency and trust in the MBS market, helping investors make informed decisions and enabling regulators to monitor systemic risks. Furthermore, this reporting plays a key role in determining credit ratings assigned to MBS, influencing investor demand and market liquidity. Overall, pool mortgage delinquency and default reporting serve as vital mechanisms for risk management and transparency in the mortgage market.

The Vital Mechanism for Pool Mortgage Delinquency and Default Reporting

- Pool mortgage delinquency and default reporting serve as vital mechanisms for risk management and transparency in the mortgage-backed securities (MBS) market. The intricate nature of MBS, which pools together thousands of individual mortgages, necessitates robust reporting systems to ensure investors have accurate insights into the performance of these investment vehicles.

- One of the primary metrics in delinquency and default reporting is the delinquency rate, which measures the proportion of mortgages within a pool that are past due on their payments. Delinquencies can range from mild, where payments are a few days late, to severe, where borrowers have missed multiple payments. Understanding the severity and frequency of delinquencies is crucial for investors to gauge the potential impact on cash flows from their MBS investments.

- Additionally, the default rate is a key indicator that measures the percentage of mortgages within a pool that have transitioned into default status, typically after a certain number of missed payments. Defaults are more severe than delinquencies as they often lead to foreclosure proceedings, where the lender takes possession of the property to recover the outstanding debt. Default rates provide insights into the credit quality of the underlying mortgages and the likelihood of losses for MBS investors.

- In-depth reporting on delinquency and default metrics enables investors to assess the risk associated with different MBS tranches. Tranches are slices of MBS pools that vary in risk and return profiles. Senior tranches, which are paid first from the cash flows generated by the underlying mortgages, are typically less risky and have lower yields. In contrast, junior or subordinate tranches, which are paid after senior tranches, carry higher risk but offer higher potential returns. Delinquency and default reporting help investors determine the appropriate risk-adjusted return for each tranche, guiding their investment decisions.

- Moreover, timely and accurate reporting of delinquency and default data is essential for maintaining transparency and trust in the MBS market. Investors rely on this information to assess the health of their investments and make informed decisions. Any discrepancies or delays in reporting could erode investor confidence and disrupt market liquidity. Therefore, issuers and servicers of MBS have a responsibility to provide comprehensive and reliable delinquency and default reports to investors and regulatory authorities.

- Regulators also closely monitor delinquency and default reporting to assess systemic risks in the financial system. The 2008 financial crisis highlighted the interconnectedness of mortgage markets and the broader economy, underscoring the importance of monitoring mortgage-related risks. Regulators use delinquency and default data to identify trends, assess the resilience of financial institutions, and implement appropriate policy measures to mitigate systemic risks. Enhanced reporting requirements and greater transparency have been key regulatory responses to improve risk management in the mortgage market post-crisis.

- Furthermore, delinquency and default reporting play a crucial role in determining credit ratings assigned to MBS. Credit rating agencies assess the creditworthiness of MBS tranches based on various factors, including the quality of underlying mortgages and historical performance data. Delinquency and default metrics provide valuable inputs for credit rating models, helping agencies assign accurate ratings that reflect the risk of default and loss for investors. Higher delinquency and default rates may result in lower credit ratings for MBS tranches, reducing investor demand and liquidity in the market.

- Investors use delinquency and default reporting not only to assess current risks but also to forecast future performance. Trends in delinquency and default rates can provide valuable insights into the direction of the housing market and broader economic conditions. Rising delinquency rates may signal economic distress or weakening borrower credit quality, while declining rates may indicate improving conditions. Investors analyze these trends to adjust their investment strategies and portfolio allocations accordingly, seeking to maximize returns while managing risk exposure.

conclusion:

pool mortgage delinquency and default reporting are essential components of risk management and transparency in the MBS market. These reports provide investors with critical insights into the performance of their investments, enabling them to assess risk, make informed decisions, and allocate capital effectively. Timely and accurate reporting is essential for maintaining trust in the MBS market and facilitating regulatory oversight. By monitoring delinquency and default metrics, investors and regulators can identify emerging risks, mitigate potential losses, and promote stability in the financial system.

Pool Mortgage Delinquency and Default Reporting are indispensable for maintaining transparency, managing risk, and facilitating informed decision-making in the Mortgage-Backed Securities (MBS) market. These reports offer crucial insights into delinquency rates, default trends, and credit quality, allowing investors to assess the health of their investments and regulators to monitor systemic risks. Timely and accurate reporting enhances market integrity, fosters investor confidence, and contributes to the overall stability of the financial system.

Disclaimer: “This article is for educational & entertainment purposes.”