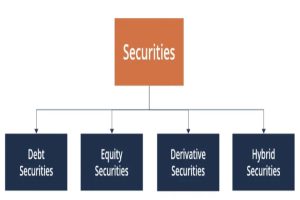

In the fast-paced world of modern financial markets, where transactions occur at lightning speed and across global borders, standardized security identifiers play a crucial role in ensuring efficiency, accuracy, and transparency. These identifiers serve as the cornerstone of financial infrastructure, facilitating the seamless identification and tracking of various financial instruments, such as stocks, bonds, derivatives, and more. As such, understanding the importance of standardized security identifiers is paramount for participants ranging from individual investors to large institutional entities.

In the fast-paced world of modern financial markets, where transactions occur at lightning speed and across global borders, standardized security identifiers play a crucial role in ensuring efficiency, accuracy, and transparency. These identifiers serve as the cornerstone of financial infrastructure, facilitating the seamless identification and tracking of various financial instruments, such as stocks, bonds, derivatives, and more. As such, understanding the importance of standardized security identifiers is paramount for participants ranging from individual investors to large institutional entities.

Standardized security identifiers are alphanumeric codes assigned to each financial instrument, providing a unique and unambiguous means of identification. These identifiers enable market participants to precisely pinpoint and differentiate between diverse securities, mitigating the risks associated with confusion or errors in transaction processing. Moreover, they serve as a common language across disparate systems and platforms, fostering interoperability and facilitating smooth communication among various stakeholders within the financial ecosystem.

In addition to promoting operational efficiency and reducing operational risks, standardized security identifiers play a pivotal role in regulatory compliance and market oversight. Regulatory authorities and governing bodies rely on these identifiers to monitor market activity, enforce regulatory requirements, and detect potential instances of market manipulation or misconduct. By providing a standardized framework for identifying securities, these identifiers enhance market transparency and integrity, bolstering investor confidence and fostering trust in the financial system.

Furthermore, standardized security identifiers are essential for the development and adoption of advanced financial technologies, such as algorithmic trading, automated settlement systems, and risk management tools. As financial markets continue to evolve and innovate, the need for robust, standardized identification mechanisms becomes increasingly pronounced, underscoring the critical role that standardized security identifiers play in shaping the future of finance.

Benefits of Standardized Security Identifiers

- Enhanced Efficiency:Standardized security identifiers streamline the process of identifying and tracking financial instruments, reducing the time and resources required for transaction processing. With a universally accepted means of identification, market participants can swiftly locate and verify the details of specific securities, facilitating faster trade execution and settlement.

- Improved Accuracy:By providing a unique identifier for each financial instrument, standardized security identifiers minimize the risk of errors and discrepancies in transaction records. This accuracy not only enhances operational efficiency but also reduces the likelihood of costly mistakes that could result in financial losses or regulatory penalties.

- Facilitated Interoperability:Standardized security identifiers serve as a common language across different trading platforms, clearing systems, and regulatory databases. This interoperability enables seamless communication and data exchange among diverse stakeholders, fostering greater transparency and collaboration within the financial ecosystem.

Regulatory Compliance and Market Oversight

- Regulatory Reporting:

Standardized security identifiers are integral to regulatory reporting requirements, enabling market participants to accurately report transaction details to regulatory authorities. These identifiers ensure consistency and accuracy in regulatory filings, facilitating compliance with reporting mandates such as those outlined in MiFID II, Dodd-Frank, and EMIR.

- Market Surveillance:

Regulatory bodies rely on standardized security identifiers to monitor market activity, detect suspicious trading patterns, and investigate potential instances of market abuse or manipulation. By providing a standardized framework for identifying securities, these identifiers enhance market surveillance capabilities, enabling regulators to maintain market integrity and investor protection.

- Risk Management:

Standardized security identifiers play a vital role in risk management practices, allowing financial institutions to assess and manage their exposure to various types of securities. By accurately identifying the underlying assets in their portfolios, firms can better analyze risk factors, implement appropriate hedging strategies, and maintain compliance with risk management guidelines and regulatory requirements.

Global Market Integration

In today’s interconnected financial landscape, standardized security identifiers facilitate seamless integration and interoperability across global markets. These identifiers provide a common language that transcends geographical boundaries, enabling investors and market participants to navigate diverse regulatory frameworks and trading platforms with ease. Whether trading on domestic exchanges or accessing international markets, standardized security identifiers ensure consistency and uniformity in identifying financial instruments, promoting efficiency and liquidity across borders.

Moreover, standardized security identifiers play a pivotal role in fostering cross-border investment and capital flows by simplifying the process of identifying and trading foreign securities. By providing a standardized means of identification, these identifiers reduce the complexities and uncertainties associated with cross-border transactions, thereby facilitating greater market access and participation for investors around the world. As globalization continues to reshape the financial landscape, standardized security identifiers serve as a fundamental building block for the seamless integration of global markets.

Furthermore, standardized security identifiers catalyze promoting transparency and investor confidence in cross-border transactions. By providing a standardized means of identifying financial instruments, these identifiers help mitigate information asymmetry and enhance market visibility, enabling investors to make more informed decisions when participating in international markets. This increased transparency not only fosters greater trust among market participants but also contributes to the stability and resilience of global financial systems.

Conclusion:

In the dynamic and interconnected world of modern financial markets, standardized security identifiers serve as the linchpin that underpins efficiency, transparency, and trust. Throughout this exploration of their importance, it has become evident that these identifiers are not merely technical codes but rather indispensable tools that enable seamless transactions, foster global market integration, and empower innovation.

As we navigate the complexities of today’s financial landscape, the significance of standardized security identifiers cannot be overstated. They form the foundation upon which market participants, regulatory bodies, and technology providers build and innovate, driving progress and shaping the future of finance. From facilitating cross-border investment to powering cutting-edge technologies like blockchain and algorithmic trading, these identifiers play a multifaceted role in driving efficiency and mitigating risk.

However, as we embrace the opportunities presented by standardized security identifiers, it is essential to remain vigilant and adaptable in the face of emerging trends and challenges. Whether navigating the rise of digital assets, addressing cybersecurity threats, or ensuring compliance with evolving regulatory requirements, stakeholders must collaborate and innovate to uphold the integrity and effectiveness of standardized security identifiers.

In closing, standardized security identifiers stand as a testament to the power of standardization and collaboration in driving progress and resilience within the financial industry. By recognizing and harnessing their importance, we can unlock new opportunities, enhance market efficiency, and ultimately build a more robust and inclusive financial ecosystem for generations to come.

Disclaimer: “This article is for educational & entertainment purposes.”