In the intricate landscape of securities trading, corporate issuer codes stand as essential alphanumeric identifiers, often overlooked but profoundly significant in facilitating efficient market operations. These codes serve as the bedrock of communication and transactional integrity, enabling seamless interactions between market participants, regulatory bodies, and financial institutions. Understanding their significance is pivotal for investors, traders, and analysts alike, as they navigate the complexities of modern financial markets.

In the intricate landscape of securities trading, corporate issuer codes stand as essential alphanumeric identifiers, often overlooked but profoundly significant in facilitating efficient market operations. These codes serve as the bedrock of communication and transactional integrity, enabling seamless interactions between market participants, regulatory bodies, and financial institutions. Understanding their significance is pivotal for investors, traders, and analysts alike, as they navigate the complexities of modern financial markets.

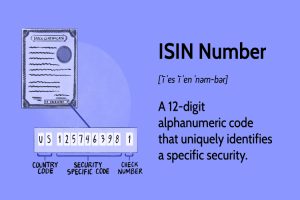

Corporate issuer codes, also known as issuer identifiers or stock codes, are unique combinations of letters and numbers assigned to companies issuing securities for trading on various exchanges. These codes, standardized across markets globally, play a crucial role in identifying specific issuers amidst the vast array of financial instruments available for investment. Whether it be stocks, bonds, or other derivatives, each security is intrinsically linked to its issuer through these codes, ensuring clarity and precision in market transactions.

Moreover, corporate issuer codes serve as a cornerstone for regulatory compliance and oversight. Regulatory bodies utilize these identifiers to monitor market activity, enforce securities laws, and ensure fair and transparent trading practices. By associating securities with their respective issuers through these codes, regulators can effectively track market dynamics, detect fraudulent activities, and maintain the integrity of the financial system.

Furthermore, corporate issuer codes facilitate efficient price discovery and market liquidity. Investors and traders rely on these identifiers to swiftly identify and evaluate securities, streamlining the process of market analysis and decision-making. Additionally, these codes enable the automation of trading processes, reducing operational complexities and enhancing market efficiency.

Here, we will explore the significance of corporate issuer codes in securities trading, exploring their multifaceted roles in fostering transparency, compliance, and liquidity within financial markets.

Importance of Corporate Issuer Codes in Market Efficiency

- Enhancing Market Transparency:Corporate issuer codes provide investors and traders with a standardized method to identify issuers, fostering transparency in market transactions. By linking securities to their respective issuers, these codes enable market participants to accurately assess the underlying companies and make informed investment decisions.

- Facilitating Regulatory Compliance: Regulatory bodies rely on corporate issuer codes to monitor market activities and enforce securities regulations. These identifiers allow regulators to track the trading of specific securities and ensure compliance with legal requirements, thereby maintaining market integrity and investor protection.

- Streamlining Trading Processes:Corporate issuer codes play a crucial role in automating trading processes, reducing operational complexities for market participants. Through electronic trading platforms and algorithmic trading systems, these codes enable swift identification and execution of trades, enhancing market liquidity and efficiency.

Challenges and Future Developments in Corporate Issuer Codes

- Global Standardization:While corporate issuer codes are standardized across many markets, challenges persist in achieving universal consistency. Discrepancies in coding systems and variations in regulatory requirements across jurisdictions can complicate cross-border trading and increase operational risks for market participants.

- Technological Innovations:Advancements in technology, such as blockchain and distributed ledger technology (DLT), offer promising solutions for improving the efficiency and reliability of corporate issuer codes. By leveraging these innovations, market infrastructure providers can enhance the accuracy, security, and accessibility of issuer identification systems, paving the way for more resilient and interconnected financial markets.

- Integration with ESG Reporting:With a growing emphasis on environmental, social, and governance (ESG) considerations in investment decision-making, there is a growing need to integrate ESG data with corporate issuer codes. Incorporating ESG metrics into issuer identification systems can provide investors with comprehensive insights into companies’ sustainability practices and performance, facilitating more holistic investment strategies and risk management approaches.

Role of Corporate Issuer Codes in Market Surveillance and Risk Management

Market Surveillance and Monitoring: Corporate issuer codes play a vital role in market surveillance and risk management by enabling regulators to monitor trading activities and detect suspicious behavior. By associating securities with their respective issuers, regulatory authorities can identify patterns of market manipulation, insider trading, and other illicit activities, thereby maintaining market integrity and investor confidence. Advanced data analytics tools and algorithms enhance the effectiveness of surveillance efforts, allowing regulators to identify potential risks and take timely enforcement actions to mitigate systemic threats.

Risk Identification and Assessment: Corporate issuer codes serve as essential components of risk identification and assessment frameworks used by financial institutions and investment firms. By linking securities to their issuers, risk managers can evaluate the creditworthiness, financial stability, and business operations of companies issuing securities, thereby assessing the inherent risks associated with investment portfolios. Integrating issuer identification data with risk modeling techniques enables investors to quantify and manage risks more effectively, optimizing portfolio diversification strategies and enhancing risk-adjusted returns. Additionally, corporate issuer codes facilitate regulatory reporting requirements related to risk management, ensuring compliance with prudential regulations and capital adequacy standards imposed by supervisory authorities.

Conclusion:

In the dynamic realm of securities trading, corporate issuer codes emerge as unsung heroes, quietly but profoundly shaping the landscape of financial markets. Their significance, often overlooked, extends far beyond mere alphanumeric combinations; they are the linchpin of market transparency, regulatory oversight, and operational efficiency. As we navigate the complexities of modern finance, it becomes increasingly evident that understanding and appreciating the role of corporate issuer codes is paramount for investors, traders, and regulators alike.

These codes serve as the connective tissue of market interactions, facilitating seamless communication and transactional integrity across global exchanges. They empower investors with the clarity needed to make informed decisions, enabling efficient price discovery and liquidity in the marketplace. Moreover, corporate issuer codes provide regulatory bodies with the tools necessary to uphold market integrity, detect fraudulent activities, and safeguard investor interests.

Looking ahead, the significance of corporate issuer codes will only continue to grow as financial markets evolve and embrace technological advancements. Innovations in data management, blockchain technology, and ESG integration hold the promise of further enhancing the efficiency and reliability of issuer identification systems. By staying vigilant and proactive in addressing emerging challenges, market stakeholders can ensure that corporate issuer codes remain a cornerstone of market functionality and investor confidence.

The significance of corporate issuer codes in securities trading cannot be overstated. They are the silent guardians of market integrity and efficiency, enabling the smooth functioning of global financial ecosystems. As we chart the course forward, let us recognize and embrace the indispensable role that corporate issuer codes play in shaping the future of finance.

Disclaimer: “This article is for educational & entertainment purposes.”