Understanding of Residential Mortgage-Backed Securities (RMBS)

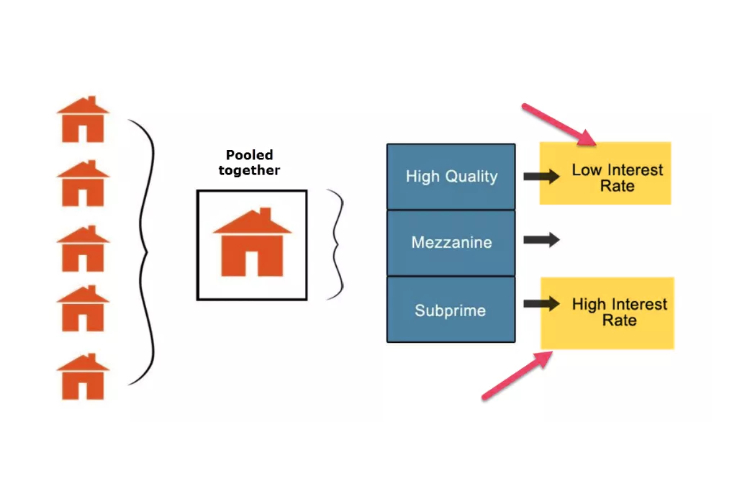

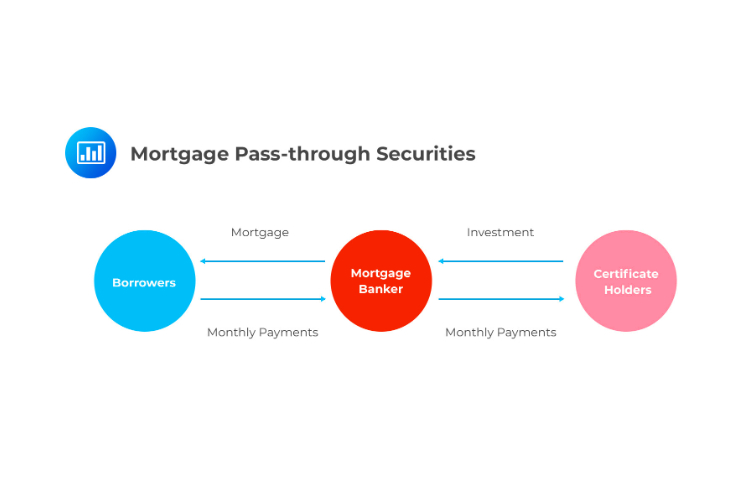

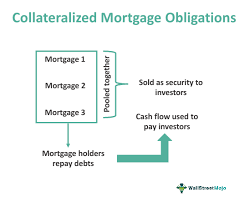

Residential Mortgage-Backed Securities (RMBS) represent a cornerstone of the modern financial landscape, offering investors exposure to the residential housing market while providing homeowners access to capital. RMBS are financial instruments that bundle together numerous residential mortgages, creating a pool of mortgage loans. These pools are then securitized and sold to investors as bonds. The cash […]

Understanding of Residential Mortgage-Backed Securities (RMBS) Read More »