Collateralized Mortgage Obligations (CMOs) stand as a cornerstone within the realm of structured finance, offering investors unique opportunities to unlock value in the mortgage market. These financial instruments, born out of the mortgage-backed securities (MBS) market, provide investors with a diverse range of risk and return profiles tailored to their specific investment objectives.

Collateralized Mortgage Obligations (CMOs) stand as a cornerstone within the realm of structured finance, offering investors unique opportunities to unlock value in the mortgage market. These financial instruments, born out of the mortgage-backed securities (MBS) market, provide investors with a diverse range of risk and return profiles tailored to their specific investment objectives.

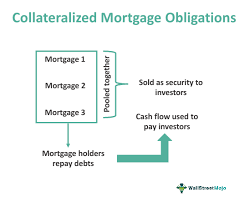

At its core, a CMO is a fixed-income security that pools together a diverse set of mortgage loans, redistributing the cash flows from these mortgages into different tranches with varying levels of risk and return. This segmentation allows investors to select tranches that align with their risk appetite, whether seeking stable cash flows or higher yields with increased risk exposure.

In this exploration of CMOs, we delve into their intricacies, examining the underlying mechanics, risk factors, and potential benefits. From the simplicity of pass-through securities to the complexity of structured tranches, we unravel the layers of CMOs to empower investors with a comprehensive understanding of these instruments.

Furthermore, we analyze the historical performance of CMOs, shedding light on their resilience during economic downturns and their ability to provide consistent returns in diverse market conditions.

Join us on this journey as we uncover the value inherent in CMOs and explore the opportunities they offer in today’s dynamic financial landscape.

Navigating Complexity: Understanding CMO Structures

Within the realm of CMOs, complexity reigns supreme. These instruments are structured in a variety of ways to meet the diverse needs of investors. Subheading such as “Z-Tranche, Sequential Pay, and PACs” illustrate the complexity and sophistication present within CMOs.

Z-Tranche, for instance, represents a particularly high-risk, high-reward segment of CMOs, often absorbing the first losses but also offering potentially lucrative returns if the underlying mortgage loans perform well. Conversely, Sequential Pay tranches prioritize the sequential distribution of cash flows to investors, offering more predictable income streams but with lower yields. Finally, Planned Amortization Class (PAC) tranches provide investors with a degree of protection against prepayment risk, ensuring a steady stream of cash flows within specified ranges of prepayment speeds.

Understanding the nuances of these structures is essential for investors seeking to unlock the full potential of CMO investments while effectively managing associated risks.

Assessing Risks and Rewards: The CMO Landscape

In the vast landscape of Collateralized Mortgage Obligations (CMOs), investors encounter a spectrum of risks and rewards. Heading into this territory requires a comprehensive understanding of the potential pitfalls and opportunities inherent in these structured securities.

Risk Factors in CMOs

One of the primary risks associated with CMOs is prepayment risk. When homeowners refinance or pay off their mortgages early, it can disrupt the expected cash flows to CMO investors, particularly those holding lower-yielding tranches. Interest rate risk is another significant concern, as changes in interest rates can impact the present value of future cash flows, affecting the prices of CMO securities.

Rewards and Benefits

Despite these risks, CMOs offer enticing rewards for investors adept at navigating the complexities of the market. Higher-yielding tranches, such as Z-Tranches, provide the potential for substantial returns, albeit with increased volatility. Meanwhile, more conservative tranches, like PACs, offer stable cash flows and protection against prepayment risk, appealing to risk-averse investors seeking predictable income streams.

Market Conditions and Performance

The performance of CMOs is intricately linked to broader economic conditions and the health of the housing market. During periods of economic stability and low interest rates, CMOs may perform favorably, providing investors with attractive returns. However, economic downturns or spikes in interest rates can pose challenges for CMO investments, requiring vigilant risk management and portfolio diversification.

In navigating the CMO landscape, investors must weigh the potential rewards against the inherent risks, conducting thorough due diligence and staying abreast of market trends to make informed investment decisions. By understanding the dynamic interplay of risk factors, rewards, and market conditions, investors can effectively unlock the value of CMOs within their portfolios.

Strategies for Investing in CMOs

Navigating the complexities of the CMO market requires a strategic approach tailored to individual investment goals and risk tolerance. Here are key strategies to consider:

- Diversification: Spread investments across various CMO tranches to mitigate specific risks associated with prepayment, interest rates, and credit.

- Risk Assessment: Conduct thorough due diligence to assess the underlying collateral quality, prepayment risk, and structural intricacies of each CMO tranche.

- Yield Curve Analysis: Monitor the yield curve and interest rate expectations to anticipate potential shifts in the pricing and performance of CMO securities.

- Active Management: Employ active portfolio management techniques to optimize risk-adjusted returns and capitalize on market inefficiencies.

- Duration Matching: Align the duration of CMO investments with specific investment horizons and risk preferences to manage interest rate risk effectively.

- Stress Testing: Perform stress tests to evaluate the resilience of CMO investments under adverse market conditions and identify potential vulnerabilities.

By implementing these strategies, investors can navigate the intricacies of the CMO market with confidence, maximizing the potential for value creation while effectively managing risks.

Conclusion

In conclusion, Collateralized Mortgage Obligations (CMOs) offer investors a unique opportunity to unlock value in the mortgage market through structured securities. Despite their complexity, CMOs provide a diverse range of risk and return profiles, catering to various investment objectives. Through thorough understanding and strategic approaches, investors can effectively navigate the CMO landscape, capitalizing on opportunities while mitigating risks.

By diversifying investments across different CMO tranches, conducting rigorous risk assessments, and actively managing portfolios, investors can optimize risk-adjusted returns and capitalize on market opportunities. Furthermore, staying informed about market trends and conducting stress tests ensures resilience against adverse scenarios.

In today’s dynamic financial landscape, CMOs remain an essential component of structured finance, offering investors the potential for attractive returns and portfolio diversification. With prudent investment strategies and a commitment to diligent risk management, investors can harness the value inherent in CMOs to achieve their financial objectives.

Navigating the CMO market requires diligence and strategy. By leveraging diversification, active management, and market insights, investors can unlock the value of CMOs while managing risks effectively for long-term financial success.

Disclaimer: “This article is for educational & entertainment purposes.”