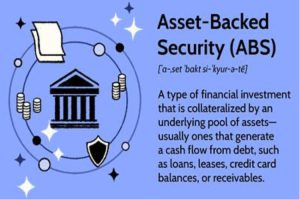

Mortgage asset-backed securities (MBS) represent a vital component of the global financial landscape, serving as a cornerstone of modern capital markets. These securities are created by pooling together individual mortgage loans, which are then securitized and sold to investors. The underlying mortgages provide the cash flows that support the MBS, offering investors exposure to the residential real estate market.

Mortgage asset-backed securities (MBS) represent a vital component of the global financial landscape, serving as a cornerstone of modern capital markets. These securities are created by pooling together individual mortgage loans, which are then securitized and sold to investors. The underlying mortgages provide the cash flows that support the MBS, offering investors exposure to the residential real estate market.

The process begins with financial institutions originating mortgages, which are typically home loans extended to individuals or families for purchasing property. These mortgages are then bundled together based on similar characteristics such as interest rates, terms, and credit quality. The resulting pool of mortgages forms the collateral for the MBS issuance.

Investors in MBS receive payments based on the principal and interest collected from the underlying mortgage loans. These payments are structured into different tranches, each with its own risk and return profile. Higher-rated tranches offer lower yields but greater security, while lower-rated tranches provide higher potential returns but come with increased risk.

Overall, mortgage asset-backed securities play a crucial role in providing liquidity to the housing market and enabling financial institutions to manage their risk exposure. Understanding the intricacies of MBS is essential for investors, policymakers, and market participants alike, as they navigate the complexities of modern finance.

Structure and Characteristics of Mortgage Asset-Backed Securities

Mortgage Loan Origination and Aggregation

The foundation of mortgage asset-backed securities lies in the origination and aggregation of individual mortgage loans. Financial institutions, including banks, credit unions, and mortgage lenders, extend these loans to homebuyers, providing the necessary capital for purchasing residential properties. Mortgage originators assess borrowers’ creditworthiness, income levels, employment history, and other relevant factors to determine the terms and conditions of the loans.

Once originated, mortgage loans are aggregated based on various criteria such as geographic location, loan-to-value ratio, and credit score. This aggregation process allows financial institutions to create pools of mortgages with similar risk characteristics. These mortgage pools serve as the collateral for the issuance of MBS.

Securitization Process

Securitization is the process of transforming illiquid assets, such as individual mortgage loans, into tradable securities. In the case of MBS, the pooled mortgage loans are transferred to a special purpose vehicle (SPV), which is a legal entity created solely for the purpose of issuing securities. The SPV then issues MBS to investors, with the cash flows from the underlying mortgage loans backing these securities.

The securitization process involves several key steps, including structuring the securities, credit enhancement, and the issuance of different tranches. Structuring involves dividing the cash flows from the underlying mortgages into different segments, or tranches, each with its own priority of payment and risk profile. Credit enhancement mechanisms such as overcollateralization, subordination, and insurance are employed to mitigate the risk of default and enhance the creditworthiness of the securities.

Risks and Returns

Investing in MBS entails exposure to various risks, including credit risk, prepayment risk, and interest rate risk. Credit risk refers to the possibility of default by the underlying mortgage borrowers, which can lead to losses for investors. Prepayment risk arises from the early repayment of mortgages, which can disrupt the expected cash flows to MBS investors. Interest rate risk stems from changes in interest rates, which can impact the present value of future cash flows from the securities.

To compensate investors for bearing these risks, MBS offer returns in the form of interest payments and principal repayments. The interest rates on MBS are typically higher than those on government bonds, reflecting the additional risk associated with mortgage-backed securities. Additionally, MBS are structured into different tranches with varying levels of risk and return, allowing investors to choose securities that align with their risk preferences and investment objectives.

Market Dynamics and Regulation

The market for mortgage asset-backed securities is influenced by various factors, including housing market conditions, interest rate movements, and investor sentiment. Changes in housing prices, mortgage delinquency rates, and economic conditions can impact the performance of MBS and investor demand for these securities.

Regulation plays a crucial role in shaping the MBS market, with government agencies such as the Securities and Exchange Commission (SEC) and the Federal Housing Finance Agency (FHFA) overseeing securities issuance and market participants’ activities. Additionally, regulatory reforms implemented in the aftermath of the global financial crisis have aimed to enhance transparency, improve risk management practices, and strengthen investor protection in the MBS market.

In summary, mortgage asset-backed securities are complex financial instruments that play a significant role in the global capital markets. Understanding the structure, characteristics, and dynamics of MBS is essential for investors, policymakers, and market participants to navigate this important segment of the financial landscape.

Challenges and Future Outlook

Despite their importance in financial markets, mortgage asset-backed securities face several challenges and uncertainties. One of the ongoing challenges is the potential for regulatory changes and reforms, which could impact the structure and functioning of the MBS market. Regulatory scrutiny often focuses on improving transparency, enhancing risk management practices, and addressing systemic risks associated with mortgage securitization.

Moreover, fluctuations in housing market conditions, interest rates, and macroeconomic factors can introduce volatility and uncertainty into the performance of MBS. For example, a sharp increase in mortgage delinquencies or a downturn in the housing market could adversely affect the credit quality of MBS and investor confidence in these securities.

Looking ahead, technological advancements and innovations in financial services could reshape the landscape of mortgage securitization. Blockchain technology, for instance, holds the potential to streamline and automate the issuance, trading, and settlement of MBS, reducing costs and enhancing efficiency in the market.

Overall, while mortgage asset-backed securities face challenges and uncertainties, they are likely to remain an integral part of the global financial system, providing investors with exposure to the residential real estate market and serving as a source of funding for mortgage lending. Adaptation to regulatory changes, market dynamics, and technological innovations will be key to ensuring the continued resilience and relevance of MBS in the future.

Conclusion

In conclusion, mortgage asset-backed securities represent a crucial component of the global financial system, providing liquidity to the housing market and offering investors exposure to residential real estate. Despite facing challenges such as regulatory changes, market volatility, and evolving investor preferences, MBS are likely to remain resilient and continue to evolve with technological advancements and shifting market dynamics. As stakeholders adapt to these changes and embrace responsible securitization practices, mortgage-backed securities will continue to play a vital role in shaping the future of finance.

Disclaimer: “This article is for educational & entertainment purposes.”