The evaluation of trends in mortgage securitization data reports serves as a critical compass for navigating the complex landscape of financial markets. Mortgage securitization, the process of bundling mortgages into tradable securities, has long been a cornerstone of global finance, enabling liquidity and risk management. As such, comprehensive data reports play an indispensable role in understanding the dynamics, risks, and opportunities within this market.

The evaluation of trends in mortgage securitization data reports serves as a critical compass for navigating the complex landscape of financial markets. Mortgage securitization, the process of bundling mortgages into tradable securities, has long been a cornerstone of global finance, enabling liquidity and risk management. As such, comprehensive data reports play an indispensable role in understanding the dynamics, risks, and opportunities within this market.

These reports provide a wealth of information, ranging from the composition of mortgage-backed securities (MBS) to the performance of underlying loans, default rates, prepayment speeds, and investor preferences. By meticulously analyzing these datasets, stakeholders gain invaluable insights into market trends, investor behavior, regulatory compliance, and potential risks.

Moreover, in an ever-evolving financial landscape, the evaluation of mortgage securitization data reports is essential for identifying emerging patterns and assessing the resilience of financial systems. It allows policymakers, investors, regulators, and analysts to gauge the health of mortgage markets, anticipate shifts in investor sentiment, and formulate informed strategies to mitigate risks or capitalize on opportunities.

In this report, we delve into the intricacies of mortgage securitization data, examining key trends, anomalies, and their implications for the broader financial ecosystem. Through rigorous analysis and interpretation of these reports, we aim to provide stakeholders with actionable insights to navigate the dynamic terrain of mortgage-backed securities effectively.

-

Overview of Mortgage Securitization

Mortgage securitization is a process in which mortgages are pooled together and sold as securities to investors. This process transforms illiquid mortgage loans into tradable assets, providing liquidity to lenders and allowing them to originate more loans. The securities created through mortgage securitization are known as mortgage-backed securities (MBS).

-

Evolution of Mortgage Securitization

The practice of mortgage securitization gained prominence in the United States in the 1970s with the establishment of Government-Sponsored Enterprises (GSEs) such as Fannie Mae and Freddie Mac. These entities played a significant role in standardizing mortgage-backed securities and facilitating their widespread adoption in the financial markets. Over time, mortgage securitization evolved, with the emergence of private-label securitization and complex structured products.

-

Components of Mortgage Securitization Data Reports

Mortgage securitization data reports contain a wealth of information about the underlying mortgages, the securities themselves, and the performance of both. Key components of these reports include:

- Mortgage Characteristics: Information about the underlying mortgages, including loan-to-value ratios, credit scores of borrowers, loan types (fixed-rate, adjustable-rate), and geographic distribution.

- Securities Composition: Details about the composition of mortgage-backed securities, such as tranches, coupon rates, and maturity dates.

- Performance Metrics: Data on the performance of mortgage-backed securities, including prepayment speeds, delinquency rates, default rates, and loss severity.

- Investor Preferences: Insights into investor demand for mortgage-backed securities, including yield preferences, risk appetite, and market sentiment.

-

Importance of Analyzing Trends in Mortgage Securitization Data

Analyzing trends in mortgage securitization data is crucial for several reasons:

- Risk Management: Identifying trends in default rates, prepayment speeds, and other performance metrics helps investors and lenders assess and manage risks associated with mortgage-backed securities.

- Regulatory Compliance: Understanding market trends and regulatory requirements ensures compliance with relevant regulations governing mortgage securitization.

- Investment Decision-Making: Investors rely on trend analysis to make informed decisions about investing in mortgage-backed securities, taking into account factors such as yield potential, credit risk, and market conditions.

- Market Monitoring: Trend analysis provides insights into the overall health of mortgage markets, helping policymakers and regulators monitor for signs of instability or systemic risk.

-

Analytical Techniques for Evaluating Mortgage Securitization Data

Several analytical techniques are employed to evaluate trends in mortgage securitization data:

- Statistical Analysis: Statistical methods such as regression analysis, time-series analysis, and correlation analysis are used to identify patterns, relationships, and trends in mortgage securitization data.

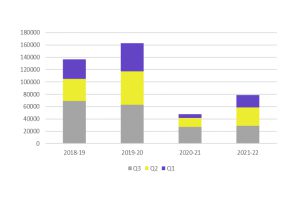

- Data Visualization: Graphical representations such as charts, graphs, and heatmaps help visualize trends in mortgage securitization data, making complex patterns easier to interpret.

- Scenario Analysis: Scenario analysis involves assessing the impact of different scenarios or events on mortgage-backed securities, helping investors understand potential risks and opportunities.

Navigating the market quite effectively with Mortgage securitization data reports

Navigating the market effectively with mortgage securitization data reports is essential for investors, lenders, regulators, and policymakers alike. These reports provide a comprehensive overview of mortgage-backed securities (MBS), offering valuable insights into market trends, risks, and opportunities.

Investors rely on mortgage securitization data reports to make informed investment decisions, assessing factors such as yield potential, credit risk, and market sentiment. By analyzing trends in MBS performance metrics like prepayment speeds, delinquency rates, and default rates, investors can manage risks effectively and optimize their investment portfolios.

Lenders utilize mortgage securitization data reports to monitor the health of mortgage markets, identify emerging trends, and adjust lending practices accordingly. Understanding investor preferences and market dynamics helps lenders originate loans that are attractive to investors, thereby facilitating liquidity in the mortgage market.

Regulators and policymakers rely on these reports to monitor for signs of instability or systemic risk in the mortgage market. By analyzing trends in mortgage securitization data, regulators can develop and implement effective policies to safeguard financial stability and protect consumers.

Overall, mortgage securitization data reports play a vital role in navigating the market effectively, enabling stakeholders to make informed decisions and adapt to changing market conditions.

Conclusion

In conclusion, mortgage securitization data reports serve as indispensable tools for navigating the complex landscape of mortgage-backed securities markets. Through comprehensive analysis of trends in these reports, investors, lenders, regulators, and policymakers can effectively manage risks, capitalize on opportunities, and safeguard financial stability. By leveraging analytical techniques and case studies, stakeholders gain valuable insights into market dynamics, investor preferences, and regulatory compliance requirements.

As the mortgage market continues to evolve, the importance of timely and accurate data analysis cannot be overstated. By staying abreast of emerging trends and market developments, stakeholders can adapt their strategies and practices to thrive in an ever-changing environment. Ultimately, mortgage securitization data reports play a pivotal role in facilitating liquidity, fostering transparency, and promoting sustainable growth in the mortgage-backed securities market.

Disclaimer: “This article is for educational & entertainment purposes.”