In today’s dynamic financial landscape, the effective management of loan portfolios is paramount for financial institutions seeking to mitigate risk and maximize returns. Among the arsenal of tools available, securitization stands out as a powerful strategy to optimize portfolio performance while balancing risk exposure. This paper delves into the realm of securitization loan portfolio analysis, exploring its significance in enabling informed decision-making and robust risk management practices.

In today’s dynamic financial landscape, the effective management of loan portfolios is paramount for financial institutions seeking to mitigate risk and maximize returns. Among the arsenal of tools available, securitization stands out as a powerful strategy to optimize portfolio performance while balancing risk exposure. This paper delves into the realm of securitization loan portfolio analysis, exploring its significance in enabling informed decision-making and robust risk management practices.

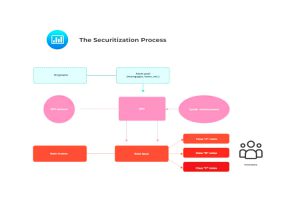

Securitization involves the pooling of various types of loans, such as mortgages, auto loans, or credit card debt, and transforming them into securities that can be sold to investors. This process not only facilitates liquidity but also allows financial institutions to transfer risk associated with these loans to investors. However, the success of securitization hinges on a comprehensive understanding of the underlying assets, their performance dynamics, and the broader market conditions.

Effective portfolio analysis is essential for identifying suitable assets for securitization, assessing their credit quality, and determining appropriate pricing strategies. Moreover, ongoing monitoring and evaluation are critical to managing risks associated with changes in economic conditions, borrower behavior, and regulatory environments.

By leveraging advanced analytics and data-driven insights, financial institutions can optimize securitization structures, enhance portfolio performance, and effectively manage risks. Through a systematic approach to loan portfolio analysis, decision-makers can make informed choices that align with their strategic objectives while maintaining regulatory compliance and safeguarding investor interests.

This paper aims to shed light on the pivotal role of securitization loan portfolio analysis in guiding prudent decision-making and fostering resilient risk management practices within the financial industry. Through a deeper understanding of the intricacies involved, stakeholders can navigate the complexities of securitization with confidence, driving sustainable value creation and resilience in an ever-evolving market landscape.

Understanding the Dynamics of Securitization

Securitization is a complex financial process that involves several key stages, each with its own set of dynamics and considerations.

- Asset Selection and Pooling

One of the initial steps in securitization is the careful selection and pooling of assets. Financial institutions must evaluate various types of loans to determine their suitability for securitization. Factors such as credit quality, historical performance, and asset characteristics play a crucial role in this process. Additionally, the composition of the asset pool must be diverse enough to spread risk effectively while ensuring investor appetite for the resulting securities.

- Structuring and Tranching

Once the asset pool is established, the next step is structuring the securitization transaction. This involves dividing the pool into different tranches, each with its own risk-return profile. The senior tranches typically receive priority in terms of cash flows and carry lower risk, while subordinate tranches offer higher potential returns but are more susceptible to losses. Structuring decisions must balance the interests of investors with the need to maintain credit enhancement levels and regulatory requirements.

Leveraging Data Analytics for Portfolio Analysis

In today’s data-rich environment, leveraging advanced analytics is crucial for effective portfolio analysis in securitization.

- Credit Risk Assessment

Data analytics enables financial institutions to conduct comprehensive credit risk assessments of underlying assets. By analyzing historical performance data, borrower profiles, and macroeconomic indicators, institutions can assess the likelihood of default and loss severity for each asset. This information is vital for determining credit enhancement levels, pricing securities, and allocating risk across different tranches.

- Cash Flow Modeling and Stress Testing

Cash flow modeling and stress testing are essential tools for evaluating the resilience of securitized portfolios under various scenarios. By simulating different economic conditions, interest rate movements, and borrower behavior patterns, institutions can assess the impact on cash flows and potential losses. This allows decision-makers to identify vulnerabilities, adjust risk management strategies, and ensure the stability of cash flows to investors.

Regulatory Compliance and Risk Management

Navigating the regulatory landscape is a critical aspect of securitization loan portfolio analysis.

- Regulatory Compliance

Financial institutions must adhere to a myriad of regulatory requirements governing securitization transactions. These regulations, such as Basel III, Dodd-Frank, and the Sarbanes-Oxley Act, impose stringent standards for risk retention, disclosure, and reporting. Compliance with these regulations is essential to maintain investor confidence, mitigate legal risks, and avoid regulatory penalties.

- Risk Management Framework

A robust risk management framework is essential for identifying, measuring, and mitigating risks associated with securitized portfolios. This framework should encompass a comprehensive set of policies, procedures, and controls tailored to the unique characteristics of securitization. Key risk areas include credit risk, liquidity risk, market risk, and operational risk. By implementing effective risk management practices, institutions can safeguard their financial stability and protect investor interests.

Securitization loan portfolio analysis is a multifaceted process that requires a deep understanding of market dynamics, sophisticated analytics capabilities, and a robust risk management framework. By navigating these complexities effectively, financial institutions can unlock the full potential of securitization as a tool for optimizing portfolio performance and managing risk.

How Securitization loan portfolio analysis helps understanding of market

Securitization loan portfolio analysis provides invaluable insights into market dynamics by offering a granular view of underlying asset performance and risk profiles. By analyzing historical data and market trends, financial institutions can identify emerging patterns, correlations, and vulnerabilities within their securitized portfolios. This understanding enables decision-makers to anticipate market shifts, assess the impact on asset valuations, and adjust risk management strategies accordingly.

Furthermore, securitization loan portfolio analysis facilitates benchmarking against industry standards and peer performance metrics, providing context for evaluating portfolio performance relative to market norms. Through continuous monitoring and evaluation, financial institutions can stay agile in response to changing market conditions, optimizing their securitization strategies to capitalize on opportunities and mitigate risks effectively. Ultimately, securitization loan portfolio analysis serves as a vital tool for enhancing market intelligence, informing strategic decision-making, and maximizing value creation in dynamic financial markets.

Conclusion

In conclusion, securitization loan portfolio analysis is a critical tool for financial institutions to navigate the complexities of the market landscape. By leveraging advanced analytics and data-driven insights, institutions can make informed decisions, optimize portfolio performance, and effectively manage risks associated with securitized assets. This analytical approach enables proactive adaptation to changing market conditions, ensuring resilience and value creation over time. Moreover, compliance with regulatory standards and adherence to robust risk management practices are imperative for maintaining investor confidence and sustaining long-term success in the dynamic environment of securitization.

Disclaimer: “This article is for educational & entertainment purposes.”